Newz: HUD and OMB PAVE Rollback, Appraiser Appraisal Capacity, Fraud Alert

July 18, 2025

What’s in This Newsletter (In Order, Scroll Down)

- LIA ad: Can’t Certify the Work

- Exposure Time vs. Marketing Time: Why the Clock Matters in Appraisals By Jamie Owen

- Historic Beachfront Water Tower That Has Been Transformed Into a Sky-High Home in California for $5.5 Million

- Freddie Mac. Appraiser Capacity

- HUD and OMB Begin Rollback of PAVE Task Force

- Fraud Alert: Some Non-QM Lenders Excluding Loans Involving Certain Appraisers, Borrowers

- Mortgage applications decreased 10.0 percent from one week earlier

——————————————————

Click here to subscribe to our FREE weekly appraiser email newsletter and get the latest appraisal news

—————————————————————————

—————————————————————————–

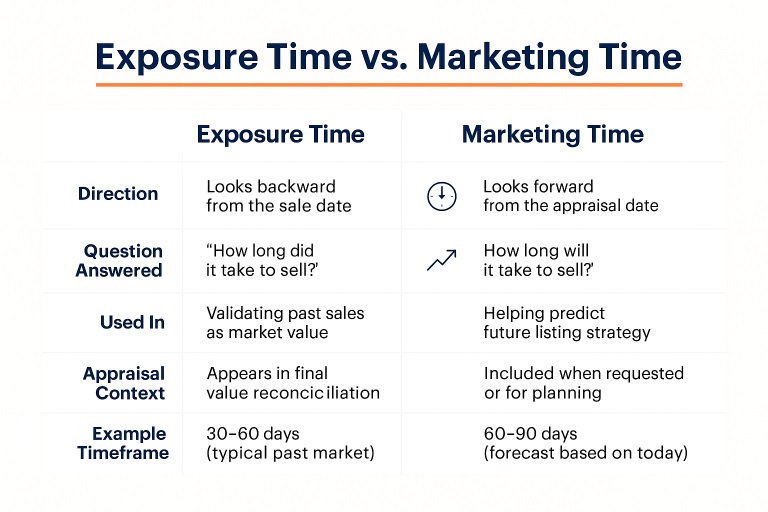

Exposure Time vs. Marketing Time: Why the Clock Matters in Appraisals

By Jamie Owen

Excerpts: Exposure Time: The Clock That Ticks Backward

Imagine standing in the kitchen of a colonial in Gordon Square that just sold last week. The buyers are thrilled, the sellers are relieved, and the agent is probably already on to the following listing. But in that moment, the appraiser has to ask: how long would this house have needed to be on the market to attract a willing buyer and sell at that exact price?

That’s exposure time—the hypothetical time the property was exposed to the open market before the sale, assuming it sold for fair market value.

Appraisers include this estimate to show that the sale wasn’t rushed, distressed, or out of step with the broader market. It’s a way of saying: “This was a typical deal in a typical market, and the sale price reflects that.”

Marketing Time: The Clock That Ticks Forward

Let’s shift the scene. You’re standing in the living room of a Cleveland Heights Tudor, preparing an appraisal for a homeowner who’s thinking about listing soon. They want to know not just what it’s worth today, but how long it might take to se

My comments: Worth reading. Excellent understandable article and graphic above. Good Case Study (A Hypothetical Example). Written for home owners, real estate agents, etc. but a good review for appraisers. This topic can be confusing for appraisers.

—————————————————————————————-

Historic Beachfront Water Tower That Has Been Transformed Into a Sky-High Home in California for $5.5 Million

Excerpts: The historic Seal Beach Water Tower dates to 1892, when it was built to hold water for passing steam engines, a role that it held for nearly 100 years.

In 1985, it was converted into a 2,828-square-foot, single-family residence that quickly became one of the most talked-about dwellings in Seal Beach. The interest appears to be alive and well 40 years later, with the home quickly shooting to the top of the week’s most popular homes list.

History buffs will love the four-bedroom home’s period details, including a vintage tool display “unearthed during the 1940s tribute” and a bedroom “themed after the only known pirate to haunt these shores.”

Other eye-catching updates include a foyer water feature; an elevator and circular staircase for easy access; a compass rose design found in the hardwood floors; a third-floor modern kitchen; a model train “weaving through the rafters”; a fifth-level, open-air rotunda; and a stained-glass cupola.

To read the listing and see 74 photos, Click Here

My comments: Very interesting! Check out the photos. I love the elevator: a long way to the top…

—————————————————————————————-

Freddie Mac. Appraiser Appraisal Capacity

Updated June 2025

Images:

GSE Appraisals per Appraiser – State View

UCDP Appraisal Volume

To download the PDF document, Click Here

My comments: Very interesting. Shows comparison by state.

—————————————————————————————-

Are you getting too many ad-only emails?

4 ways to get only the FREE email newsletters and NOT the ad-only emails.

1. Twitter: https://twitter.com/appraisaltoday Posted by noon Friday

2. Read on blog www.appraisaltoday.com/blog Posted by noon Friday. You can subscribe to the blog in the upper right of each blog page. NOTE: the popular ads with liability tips are below the first topic on my blog posts.

3. Email Archives: https://appraisaltoday.com/archives

(posted by noon Friday) The link is above and to the left of the big yellow email signup form. Newsletters start with “Newz.” Contains all recent emails sent.

4. Link to the 10 most recent newsletters (no ads) at www.appraisaltoday.com. Scroll down past the big yellow signup block. The newsletters have abbreviated titles, taken from their blog posts.

To read more about the 4 ways, plus information on why I take ads, etc.

——————————————————————–

Let’s Talk About Subpoenas

By Claudia Gaglione, Esq.

At some point during your career as a professional appraiser you will have to

respond to one or more subpoenas.

A subpoena is NOT a lawsuit. Depending upon the jurisdiction you are in the

subpoena form might look like a summons but it is very different; however it is an important legal document and it cannot be ignored.

You must first determine the type of subpoena you are dealing with and what

you have to do to comply.

A DOCUMENT or BUSINESS RECORDS SUBPOENA may require that you

produce copies of certain documents to a law firm, to a copy service or even to the court by a certain date.

Most insurance policies provide coverage that extends to Subpoena

Response. Don’t hesitate to notify the carrier if you are served with a subpoena that seeks the production of documents. There are a lot of things to consider when responding to a subpoena and it might be better for you to have some help and guidance.

To read the full article, plus 2+ years of previous issues, subscribe to the paid Appraisal Today at www.appraisaltoday.com/order .

Not sure if you want to subscribe?

Sign up for monthly auto renewal for $8.25!

Cancel at any time for any reason! You will receive a prorated refund.

$8.25 per month, $24.75 per quarter, and $89 per year (Best Buy)

or $99 per year or $169 for two years

Subscribers get FREE: past 18+ months of past newsletters

What’s the difference between the Appraisal Today free Weekly email newsletter and the paid Monthly newsletter? Click here for more info.

————————————————————–

If you are a paid subscriber and did not receive the July 2025 issue emailed on Tuesday , July 1 2025 please email info@appraisaltoday.com, and we will send it to you. You can also hit the reply button. Be sure to include a comment requesting it.

———————————————————————————–

HUD and OMB Begin Rollback of PAVE Task Force

July 10, 2025

Excerpts: U.S. Department of Housing and Urban Development (HUD) Secretary Scott Turner and Acting Administrator of the Office of Information and Regulatory Affairs (OIRA) at the Office of Management and Budget (OMB) Jeffrey Clark have announced the termination of policies introduced under the Property Appraisal and Valuation Equity (PAVE) task force. As part of the PAVE task force, members were directed to issue guidance on anti-discrimination obligations, review policies and practices, and issue new policies focused on “eliminating bias and advancing equity in home appraisals.”

Eliminating core policies of the PAVE Task Force upholds President Trump’s Executive Orders, including Ending Radical and Wasteful Government DEI Programs and Preferencing and Delivering Emergency Price Relief for American Families and Defeating the Cost-of-Living Crisis.

The termination of specific policies eliminates unnecessary regulatory hurdles imposed on lenders, appraisers, and other program participants, which will allow the Federal Housing Administration (FHA) to better serve American homebuyers and homeowners.

To read more, Click Here

My comments: I had been hoping for this for a while. We all hate appraiser bias accusations, excessive useless required CE, etc.

—————————————————————————————-

Fraud Alert: Some Non-QM Lenders Excluding Loans Involving Certain Appraisers, Borrowers

Jul 15, 2025

Excerpts: Fannie Mae has issued an alert warning of mortgage fraud in the Mid-Atlantic and Northeast regions.

Excerpts: Fannie Mae warns of multi-state, broker-led mortgage fraud linked with investment properties, a settlement company, multiple LLCs

Fannie Mae has issued a fraud alert warning the mortgage industry about a growing pattern of fraudulent activity tied to two- to four-unit investment properties in New Jersey and surrounding states.

At the heart of the scheme, according to the GSE, is a mortgage broker working in concert with multiple limited liability companies (LLCs) and a New Jersey-based settlement company, exploiting gaps in refinance processes to extract inflated loan amounts.

The Scheme

According to Fannie Mae, the fraud involves deed transfers to LLCs, followed by limited cash-out refinance applications roughly 60 to 180 days later — but the individuals applying for the loans aren’t actually on the title.

To drive up loan amounts, the properties are appraised at inflated values much higher than what they’re worth.

To read more, Click Here

To learn about non-QM mortgages, Click Here

My comments: It’s been a very long time since I read about mortgage fraud that included appraisers.

—————————————————————————————-

HOW TO USE THE NUMBERS BELOW. Appraisals are ordered after the loan application. These numbers tell you the future for the next few weeks. For more information on how they are compiled, Click Here.

Note: I publish a graph of this data every month in my paid monthly newsletter, Appraisal Today. For more information or get a FREE sample go to www.appraisaltoday.com/order Or call 510-865-8041, MTW, 7 AM to noon, Pacific time.

My comments: Rates are going up and down. We are all waiting for rates to drop in 2025.

Mortgage applications decreased 10.0 percent from one week earlier

WASHINGTON, D.C. (July 16, 2025) — Mortgage applications decreased 10.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 11, 2025. Last week’s results included an adjustment for the Fourth of July holiday.

The Market Composite Index, a measure of mortgage loan application volume, decreased 10.0 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 13 percent compared with the previous week. The Refinance Index decreased 7 percent from the previous week and was 25 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 12 percent from one week earlier. The unadjusted Purchase Index increased 11 percent compared with the previous week and was 13 percent higher than the same week one year ago.

“Treasury yields finished higher last week on average despite an intra-week drop, driven partly by renewed concerns of the impact of tariffs on the economy. As a result, mortgage rates rose after two weeks of declines, which contributed to slower application activity,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Jumbo rates were lower than conventional rates for the third straight week, as some depositories may be positioning themselves for growth in balance sheet lending.”

Added Kan, “Purchase applications remained sensitive to both the uncertain economic outlook and the volatility in rates and declined to the slowest pace since May. Refinance applications also dipped because of higher rates, with refinance applications falling, led by VA refinances partially reversing their previous week’s gain, dropping 22 percent.”

The refinance share of mortgage activity increased to 41.1 percent of total applications from 40.0 percent the previous week. The adjustable-rate mortgage (ARM) share of activity decreased to 7.1 percent of total applications.

The FHA share of total applications increased to 19.0 percent from 17.9 percent the week prior. The VA share of total applications decreased to 12.6 percent from 13.0 percent the week prior. The USDA share of total applications decreased to 0.5 percent from 0.6 percent the week prior.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($806,500 or less) increased to 6.82 percent from 6.77 percent, with points remaining unchanged at 0.62 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The effective rate increased from last week.

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $806,500) increased to 6.75 percent from 6.69 percent, with points increasing to 0.66 from 0.65 (including the origination fee) for 80 percent LTV loans. The effective rate increased from last week.

The average contract interest rate for 30-year fixed-rate mortgages backed by the FHA increased to 6.52 percent from 6.51 percent, with points increasing to 0.86 from 0.80 (including the origination fee) for 80 percent LTV loans. The effective rate increased from last week.

The average contract interest rate for 15-year fixed-rate mortgages increased to 6.16 percent from 6.04 percent, with points remaining unchanged at 0.63 (including the origination fee) for 80 percent LTV loans. The effective rate increased from last week.

The average contract interest rate for 5/1 ARMs increased to 6.08 percent from 6.01 percent, with points decreasing to 0.45 from 0.73 (including the origination fee) for 80 percent LTV loans. The effective rate decreased from last week.

The survey covers U.S. closed-end residential mortgage applications originated through retail and consumer direct channels. The survey has been conducted weekly since 1990. Respondents include mortgage bankers, commercial banks, thrifts, and credit unions. Base period and value for all indexes is March 16, 1990=100.

—————————————————————

Ann O’Rourke, MAI, SRA, MBA

Ann O’Rourke, MAI, SRA, MBA

Appraiser and Publisher Appraisal Today

1826 Clement Ave. Suite 203 Alameda, CA 94501

Phone: 510-865-8041

Email: ann@appraisaltoday.com

Online: www.appraisaltoday.com

We want to know what you think!! Please leave a comment.