Newz: Parcel, Deed and Tax Data Differences, New URAR, Probate/Estate Appraisals

June 6, 2025

What’s in This Newsletter (In Order, Scroll Down)

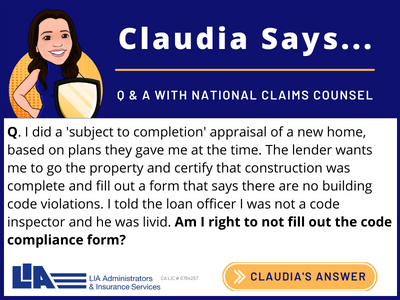

- LIA AD Problem with An Affidavit

- The Difference Between Parcel Data, Deed Data, and Tax Data

- Nautilus House in Naucalpan, Mexico

- Brains, Bytes, and Bracketing: Why Appraisers Need Both Carbon and Silicon in Their Toolkit By Ernie Durbin

- What’s new in the New URAR?

- How Probate Appraisals Really Work By Tom Horn

- An Appraiser’s Musings on Adaptive Reuse By Hal Humphreys

- Mortgage applications decreased 3.9 percent from one week earlier

————————————————————–

Click here to subscribe to our FREE weekly appraiser email newsletter and get the latest appraisal news

—————————————————————-

—————————————————————–

The Difference Between Parcel Data, Deed Data, and Tax Data

Excerpts: Parcel, deed, and tax assessor data — what’s the difference between them, and which type of data do you need?

What Is Parcel Data?

Parcels, or property boundaries, can be defined as a shape or polygon and displayed on a map. These mapped areas comprise parcel data, and they might also show points of latitude and longitude, streets, or zip codes. Parcel data also includes ownership details, acreage, and the boundaries for the parcels.

What Is Deed Data?

Deed data include the information contained within a property deed. Unlike parcel data, deed data is not map-based although the data points can be overlaid on a map. A property deed is a legal document that transfers ownership of real estate and is required for real estate transactions, legal proceedings, and tracking property ownership history.

What Is Tax Data?

Tax data are collected by the county tax assessor. Tax data include property identification, addresses, current and past property ownership, legal descriptions, property features, property values, and taxes.

As you can see, these three real estate data types have some level of overlap. However, boundary data are required for mapping purposes and deed and tax data are critical for businesses providing legal, mortgage, and titling services.

To read more, Click Here

My comments: Read more details. Very good information. This article was written by ATTOM data, who provides all the types of data above. You can read the Mortgage sections of the article to see how it affects mortgages and appraisers.

When I started my first appraisal job at an assessor’s office in 1975, I was very lucky. I appraised the land for every parcel, improved or not. I had great training on the topics above.

I went to the county records to find, read and understand deeds.

I learned how to read assessor’s parcel maps, as that is how I found the properties I appraised. I attended a 3 day class by a property surveyor to understand how they determined property maps.

When I started my appraisal business in 1975 the chief appraiser one of the local lenders I worked for required that the appraisers read title report including the deeds for every property. You initialed the report.

I doubt if many appraisers got the training that I received. I was very, very lucky.

The deeds also include easements and other restrictions. When I am not sure the parcel map has correct dimensions or there may be easements, I obtain a copy of the deed’s legal description and run down the property lines (length, angle, etc.

In my city, there are many Victorians side by side on narrow lots with garages in the rear that use the driveway between the homes for access. A client wanted to get her parking rights between her house and the neighbor. Her neighbor did not have a car now so she could use the full driveway. I told her the neighbor could sell or rent her home and her driveway parking might be gone. There was a recorded driveway easement. I told her to get a survey. She purchased a car that fit into her half of the driveway.

Another time my client and a neighbor were not in agreement on the location of a fence. I told them I assume fences are not on the property boundary, unless I have a survey. They got one and resolved their dispute.

—————————————————————————————-

Nautilus House in Naucalpan, Mexico

Excerpts: Architect’s statement: At the end of the turn-around is the piece of land, with upward topography, where the Nautilus was built. It is limited by three of its adjoining properties because each of them has high buildings. The fourth adjoining property if to the west and has wide views of a green area with mountains in the horizon.

The construction area was defined since the first studies at the back of the piece of land, leaving the pedestrian and car access at the front as well as only one façade, the so called fifth façade in architectonic language.

The social life of this dwelling place flows inside the Nautilus without any divisions. Going up the spiral stairs, continuing through the hall, going through the television room sheltered in the Nautilus belly flows the space up the spiral stairs to the study room, where you can view the mountain’s landscape.

Behind the Nautilus is wrapped the intimate and service area: bedrooms, walking closets, bathrooms and the kitchen.

To read more plus see fascinating phots, Click Here

My comment: This is one of my favorite “unique” homes.

Read more!! →