Newz: Appraisal Regulator Chaos , Cat and Raccoon Damages, Wildfire Risks

September 5, 2025

What’s in This Newsletter (In Order, Scroll Down)

NOTE: Scroll down to see Appraisal Regulator Chaos

- LIA AD: Legal Request for Old Appraisal

- The Kitty Litter Duplex: An Appraisal I Wish to Not Remember

- $300K Maryland Home Is Overrun by Feral Cats and Raccoons

- The Full Measure August 2025: Navigating Rates, Inventory, and Affordability

- Appraisal Regulatory Chaos

- The Town With No Bank: How Rural America Lost Its Mortgage Lifeline By Dallas T. Kiedrowski, MNAA

- New Cotality Wildfire Risk Report finds more than 2.6 million homes are exposed to moderate or greater wildfire risk

- Mortgage applications decreased 1.2 percent from one week earlier

—————————————————————

Click here to subscribe to our FREE weekly appraiser email newsletter and get the latest appraisal news

————————————————-

———————————————————–

The Kitty Litter Duplex: An Appraisal I Wish to Not Remember

Excerpts: How one property’s furballs left an unforgettable impression on an apartment and an appraiser

Introduction

In the world of real estate, surprises abound. Industry professionals, especially appraisers, all expect the unexpected, but even the most seasoned professionals can stumble across situations that test the limits of their experience, composure, and their judgement. There are stories of haunted houses, collapsing ceilings, and outlandish tenant actions and decorative choices (Live, Laugh, Love), but the tale of the cat-soiled duplex stands out for its sheer yuck-factor. This is the story of what should be a routine property appraisal, which became cemented in my experience stories, due to its unfathomability and coated in an unmistakable, noxious layer of feline mischief.

The Setting: An Unimposing Duplex with a Dirty Little Secret…

The Appraisal Appointment: An Unforgettable First Impression

…I could only see the flooring in the opening and a few other spots around the living room from about a foot outside the threshold, the rest of the floor was completely caked with cat poop. The walls, ceiling, and windows were all enveloped by heavy spider webs in a variety of states, while some were fresh looking, others clearly blackened from a long life filled with dust, dirt, fur, and of course fecal matter. Also, you could see multiple patches of orange mold scattered throughout the walls and ceiling. I quickly replied I would not be going in there, because it was a danger to my health and safety, which somehow surprised her….

Financial and Health Implications: When Cleanliness Becomes a Value Killer

Hygiene, general maintenance, and property values parallel each other. This may be why we have condition codes for our appraisals. Just saying…. I made sure to thoroughly explain the situation and how the value was determined in the report. I did not want this rolling back downhill and getting me. Luckily, a very gracious Fresno Construction, was able to give me a quote very quickly, which came just over $100,000 for an estimate to redo the unit in its entirety.

Conclusion

The Kitty Litter Unit stands as a testament to both the resilience of a property and the unpredictability investors face. Especially in this case, since it was for an estate of a deceased former owner.

To read more, Click Here

My comments: I appraised a house for a relocation company – one story with 3 bedrooms. There were cats on every surface above the floor, such as dressers, – all staring at me of course. In the rear of the home was a very large cat enclosure. They were rescue cats, temporarily at the home. I did not ask the owner where the cats would go when she relocated – back to the shelter or with go with her. I will never forget about all those cat eyes staring at me!

I had another relocation appraisal where the male cat had sprayed urine along several walls in the living room. I told the relocation company to replace the drywall.

Of course, I could fill up a book with dog stories. Such as two Dobermans that broke down the door of a trailer to get to me. I somehow made it to my car and I will never forget it. Or the small dogs who bit my ankles as I was trying to get through the front door (home was owned by an appraiser I knew). For both appraisals, I told my lender client to get another appraiser.

——————————————————–

300K Maryland Home Is Overrun by Feral Cats and Raccoons

Excerpts: Studio, 960 sq.ft., 4.86 acre, built in 1906

The value is in the land. Do NOT enter the house under any conditions. It is occupied by feral cats and raccoons. How do they get along? I don’t know. Be careful going on the land. It is at your own risk. The house is a teardown and is falling down, although the roof appears newer. From what we know, there is an outhouse on the property, and the drinking water comes from the stream/spring. We don’t believe there is indoor plumbing.

But where else can you get almost five acres of gorgeous Baltimore County land near streams, the NCR trail, and just steps from Bee Tree Preserve? Bring your vision and your money. Seller makes no representations or warranties to anything regarding this property. Buyer must take on responsibility for all tests, easement research, etc. The Subaru is included.

To read more, Click Here

To read the listing, Click Here

My comments: I don’t even want to think about raccoons coming through a dog door and ransacking my kitchen. I have regular raccoon visits in my back yard at night. Once, a long time ago, I left a full trash bag in the rear yard. I never did that again. They keep coming back at night hoping for something to eat, most recently last week. My cat hisses at them to let me know they are there. I shined a flashlight and made a lot of noise. The raccoon left.

——————————————————-

The Full Measure August 2025: Navigating Rates, Inventory, and Affordability

By Kevin Hecht, Appraiser and Economist

Excerpts: As we move toward the end of summer, the housing market is caught between shifting monetary policy signals, a modest rise in inventory, and the stubborn weight of affordability challenges. For appraisers, this month’s backdrop offers both clarity and caution: there are more comparable sales to analyze, but the quality and timing of those comps matter more than ever.

Prices: The Deceleration Continues

While supply is rising, prices are no longer surging. Median home prices grew just 2% year-over-year in July, according to Realtor.com’s analysis of NAR data (Realtor.com, Aug. 22, 2025). On a seasonally adjusted basis, prices are showing slight month-to-month declines.

This reflects what I’ve called in past editions the “lag trap”: comps from three to six months ago may reflect a very different pricing environment. Case-Shiller data confirm that prices have declined for several consecutive months, illustrating how contract dates and closing dates often lag current market conditions.

Final Thoughts

The national data is useful for context, but as always, the real insight comes from understanding your local market. Ask yourself: how does my region fit into this broader story of easing rates, rising inventory, and affordability pressures? Are buyers showing up in greater numbers, or are they still hesitant despite more listings?

The role of the appraiser is more important than ever in this environment. Our job is not simply to reflect past sales, but to interpret where the market is today and where it may be heading tomorrow.

Stay sharp, stay informed, and remember: in a market this dynamic, being accurate matters far more than being fast.

To read more, Click Here

My comments: Worth reading the full article. What these topics mean for appraisers is very, very helpful. These are the only articles I have seen that say what the trends mean for appraisers.

—————————————————-

Are you getting too many ad-only emails?

4 ways to get only the FREE email newsletters and NOT the ad-only emails.

1. Twitter: https://twitter.com/appraisaltoday Posted by noon Friday

2. Read on blog www.appraisaltoday.com/blog Posted by noon Friday. You can subscribe to the blog in the upper right of each blog page. NOTE: the popular ads with liability tips are below the first topic on my blog posts.

3. Email Archives: https://appraisaltoday.com/archives

(posted by noon Friday) The link is above and to the left of the big yellow email signup form. Newsletters start with “Newz.” Contains all recent emails sent.

4. Link to the 10 most recent newsletters (no ads) at www.appraisaltoday.com. Scroll down past the big yellow signup block. The newsletters have abbreviated titles, taken from their blog posts.

To read more about the 4 ways, plus information on why I take ads, etc.

—————————————————

In the September, 2025 issue of Appraisal Today

- The Future of Appraisal Regulation. The Current Regulatory System is Broken

- Appraisal Regulator “Chaos” Risks Undermining Real Estate Markets

- The Power to Define Appraisal Rules for U.S. Real Estate Belongs to TAF (The Appraisal Foundation)

Excerpts:

The Power To Define Appraisal Rules For U.S. Real Estate Belongs To TAF. It’s Desperate Not To Lose It.

The Appraisal Foundation (TAF), the governing body for appraisers across

the U.S., has overseen the way property values are determined for more than 30 years. But in recent years it has come under heightened scrutiny about its influence and effectiveness, both from within the ranks of the appraisal industry and among the federal officials who monitor it.

Since 2020, TAF has been the subject of a federal fair housing probe,

doubled its financial assets and sought to exert more control over – and extract more revenue from – appraisal certification material.

To read the full articles, plus 2+ years of previous issues, subscribe to the paid Appraisal Today at www.appraisaltoday.com/order

Not sure if you want to subscribe?

Sign up for monthly auto renewal for $8.25!

Cancel at any time for any reason! You will receive a prorated refund.

$8.25 per month, $24.75 per quarter, and $89 per year (Best Buy)

or $99 per year or $169 for two years

Subscribers get FREE: past 18+ months of past newsletters

What’s the difference between the Appraisal Today free Weekly email newsletter and the paid Monthly newsletter? Click here for more info.

———————————————————–

If you are a paid subscriber and did not receive the

September 2025 issue emailed on Friday, September 2, 2025 please email info@appraisaltoday.com, and we will send it to you. You can also hit the reply button. Be sure to include a comment requesting it.

—————————————————

The Town With No Bank: How Rural America Lost Its Mortgage Lifeline

By Dallas T. Kiedrowski, MNAA

Excerpts:

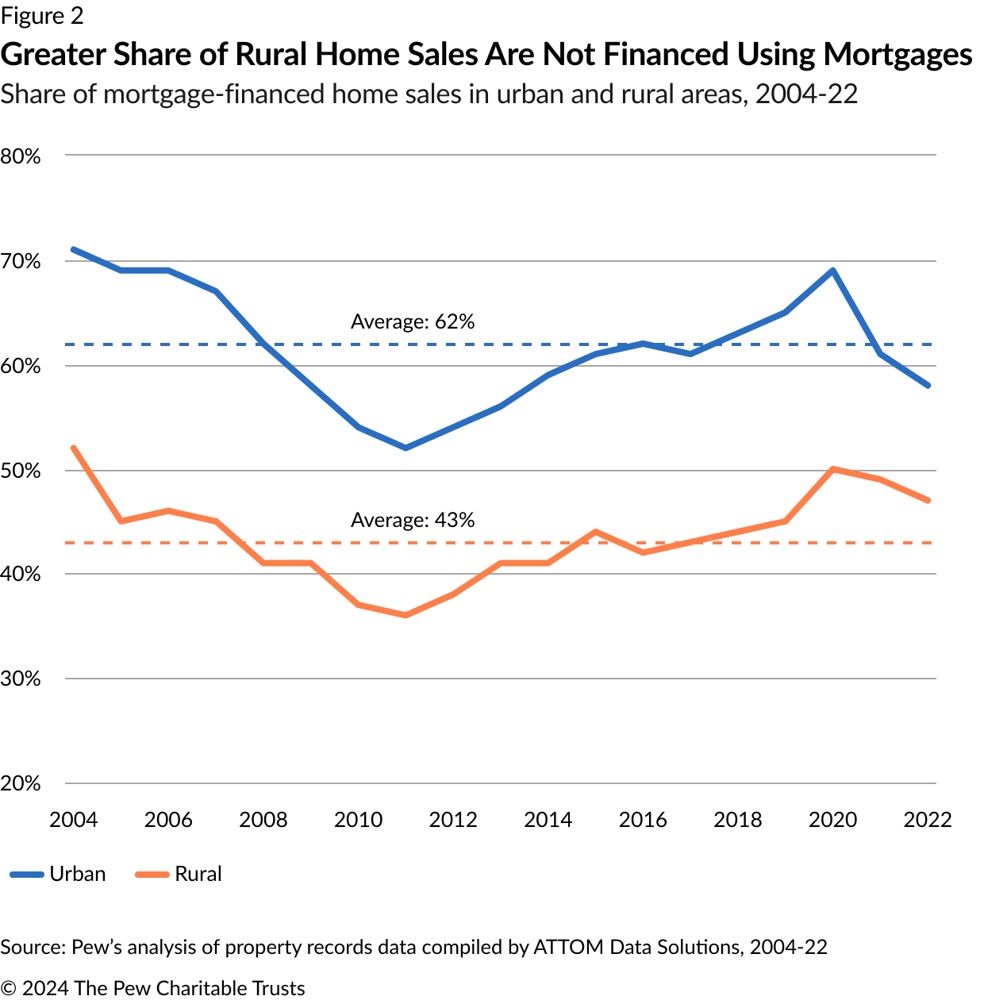

For decades, we’ve been told that the problem is demand. That people don’t want to live in rural America anymore. That lending dried up because the buyers disappeared. That it’s just the market working as it should. But what if we’ve been telling the wrong story? Because when you look closely, when you actually follow the data, the decisions, and the people left behind, it turns out rural America didn’t walk away from mortgage credit. Mortgage credit walked away from rural America.

The Collapse of Local Lending

… For rural communities, the S&L crisis was a seismic shift. The number of S&Ls was cut nearly in half between 1987 and 1996 (from about 3,622 to 1,924 institutions). And it wasn’t just S&Ls. A wave of bank consolidations swept through in the aftermath. Larger banks absorbed or out-competed small-town banks, especially after laws in the 1990s removed barriers to interstate banking. The result? Two-thirds of all banking institutions have disappeared since the 1980s, plunging from almost 18,000 banks in 1984 to under 5,000 by 2021. This great shakeout left gaping holes in the financial map of rural America. Today, of the nation’s ~1,980 rural counties, 625 have no locally owned community bank at all, double the number in 1999.

In urban and suburban markets, GSE liquidity fueled massive waves of mortgage origination. It created an entire class of homebuyers, investors, and neighborhoods that didn’t exist before. But in rural America, something strange happened. The capital came. But the loans didn’t.

…Something was getting lost in translation for rural communities. The new mortgage market excelled at making 30-year fixed loans on standard houses in large markets, but it struggled with the realities of rural lending.

The Vanishing Rural Appraisers

At the same time, the appraisal workforce, once largely trained by those local S&L’s, began to disappear. In rural counties across the U.S., there were fewer mentors, fewer apprenticeships, and soon, fewer appraisers altogether. And what happens when you don’t have an appraiser? You don’t have an appraisal. And when you don’t have an appraisal, you don’t have a loan. Without local banks hiring and mentoring new appraisers, the pipeline dried up.

A Vicious Cycle: Less Infrastructure, Less Lending, Fewer Homes

Layer by layer, a structural picture emerges. The collapse of local banks and S&Ls removed the on-the ground infrastructure of lending; the appraisers, the loan officers, the branches, the local knowledge. In its place rose a distant, centralized system that has little incentive to adapt to idiosyncratic rural needs. As that system bypasses many rural borrowers (e.g. rejecting “non-conforming” properties or declining small loans), it further depresses the volume of mortgage lending in those areas.

To read more, Click Here

My comments: I was not aware of this lender problem until I read this article. Comprehensive analysis.

When I worked for an assessor’s office in the late 1970s I appraised many rural properties. No problems. When I started my business in 1986 I worked in the Bay Area and appraised relatively few rural properties.

I used to tell appraisers (before AMCs) that when working in a rural area you had little competition. But now, GSE appraisals are much more difficult in rural areas. Fees are too low.

——————————————

New Cotality Wildfire Risk Report finds more than 2.6 million homes are exposed to moderate or greater wildfire risk

Excerpts: Wildfires, once confined to a so-called “wildfire season” are now an ever-present threat, according to a new report published today by Cotality™,a leading global property data and analytics-driven solutions provider. The 2025 Cotality Wildfire Risk Report: Priced Out & Burned Out, finds that more than 2.6 million homes in the Western United States, representing a combined reconstruction cost value of $1.3 trillion, face moderate or greater risk of wildfires, with more than one million of those homes facing very high risk.

Spread across 14 states in the Western United States, nearly half of the homes are in California (1.3 million), with Colorado (319,000), Texas (243,000), Oregon (128,000) and Arizona (124,000) rounding out the top five states with the largest number of homes at risk. These states contain a high number of homes in the Wildland-Urban Interface (WUI) where there is elevated risk due to their proximity to forested or undeveloped areas.

The report also explores the complexities of wildfires by analyzing the Palisades and Eaton fires that occurred in January2025 and resulted in devastating conflagration events. Though both Los Angeles wildfires ignited as conventional wildfires, they transitioned into wildfire-induced conflagration once the fuel shifted from vegetation to the built environment of homes and businesses. The conflagration shift dramatically alters how fires spread and magnifies potential destruction that can occur. Since 2020, wildfire-induced conflagrations have destroyed more than 26,000 structures across the country.

To read more, Click Here

My comments: Insurance coverage is more and more difficult to obtain. In California, the state has special coverage through the FAIR plan, but it is very expensive with coverage limits.

Smoke risks can be substantial. Recently, the East Coast had very bad unhealthy heavy smoke from Canadian wildfires.

Mu city is not in a wildfire area but have been affected by heavy smoke from other areas. A few years ago, there were significant lightning fires about 20 miles away. The sky near me looked like a “Nuclear dawn” in the mornings. Very scary.

—————————————————

HOW TO USE THE NUMBERS BELOW. Appraisals are ordered after the loan application. These numbers tell you the future for the next few weeks. For more information on how they are compiled, Click Here.

Note: I publish a graph of this data every month in my paid monthly newsletter, Appraisal Today. For more information or get a FREE sample go to www.appraisaltoday.com/order Or call 510-865-8041, MTW, 7 AM to noon, Pacific time.

My comments: Rates are going up and down. We are all waiting for rates to drop in 2025.

Mortgage applications decreased 1.2 percent from one week earlier

WASHINGTON, D.C. (September 3, 2025) — Mortgage applications decreased 1.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 29, 2025.

The Market Composite Index, a measure of mortgage loan application volume, decreased 1.2 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 3 percent compared with the previous week. The Refinance Index increased 1 percent from the previous week and was 20 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier. The unadjusted Purchase Index decreased 6 percent compared with the previous week and was 17 percent higher than the same week one year ago.

“Mortgage rates declined last week, with the 30-year fixed rate decreasing to its lowest level since April to 6.64 percent. However, that was not enough to spark more application activity,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Refinance applications saw a small increase from the previous week, driven by FHA and VA refinance applications, but conventional refinances declined. The FHA rate is averaging about 30 basis points lower than the conventional rate in 2025, which has made those loans relatively more appealing to eligible borrowers. Purchase activity pulled back, after a four-week run of increases, as slower homebuying activity led to declines in applications across the various loan types.”

The refinance share of mortgage activity increased to 46.9 percent of total applications from 45.3 percent the previous week. The adjustable-rate mortgage (ARM) share of activity increased to 8.8 percent of total applications.

The FHA share of total applications increased to 19.9 percent from 19.1 percent the week prior. The VA share of total applications increased to 13.8 percent from 13.3 percent the week prior. The USDA share of total applications remained unchanged at 0.5 percent from the week prior.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($806,500 or less) decreased to 6.64 percent from 6.69 percent, with points decreasing to 0.59 from 0.60 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The effective rate decreased from last week.

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $806,500) decreased to 6.58 percent from 6.67 percent, with points decreasing to 0.39 from 0.44 (including the origination fee) for 80 percent LTV loans. The effective rate decreased from last week.

The average contract interest rate for 30-year fixed-rate mortgages backed by the FHA decreased to 6.31 percent from 6.35 percent, with points decreasing to 0.74 from 0.80 (including the origination fee) for 80 percent LTV loans. The effective rate decreased from last week.

The average contract interest rate for 15-year fixed-rate mortgages decreased to 5.84 percent from 6.03 percent, with points increasing to 0.84 from 0.77 (including the origination fee) for 80 percent LTV loans. The effective rate decreased from last week.

The average contract interest rate for 5/1 ARMs decreased to 5.90 percent from 5.94 percent, with points decreasing to 0.34 from 0.68 (including the origination fee) for 80 percent LTV loans. The effective rate decreased from last week.

The survey covers U.S. closed-end residential mortgage applications originated through retail and consumer direct channels. The survey has been conducted weekly since 1990. Respondents include mortgage bankers, commercial banks, thrifts, and credit unions. Base period and value for all indexes is March 16, 1990=100.

——————————————————

Ann O’Rourke, MAI, SRA, MBA

Appraiser and Publisher Appraisal Today

1826 Clement Ave. Suite 203 Alameda, CA 94501

Phone: 510-865-8041

Email: ann@appraisaltoday.com

Online: www.appraisaltoday.com

We want to know what you think!! Please leave a comment.