Newz: Concessions, Clipboards in Appraisals?

September 19, 2025

What’s in This Newsletter (In Order, Scroll Down

-

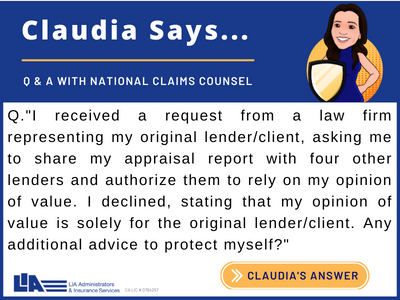

- LIA AD: Protecting My Appraisal Report

- Robots in Surgery, Clipboards in Appraisals: A Tale of Two Professions

- Custom Barndominium ‘Like No Other’ With Hobby Farm and Room for Helipad Hits the Market for $12.5 Million

- Concessions: Sellers are struggling to listen to the market by Ryan Lundquist

- Do Nearby Home Sales Affect My Home’s Value? By Tom Horn

- The Short-Term Rental Dilemma by JoAnn Apostol

-

Mortgage applications increased 29.7 percent from one week earlier

————————————————————————–

Dear Clipboard and Measuring Wheel – A Walk Down Memory Lane

Click here to subscribe to our FREE weekly appraiser email newsletter and get the latest appraisal news

—————————————————————–

————————————————————

Robots in Surgery, Clipboards in Appraisals:

A Tale of Two Professions

By Tony Pistilli

September 15, 2025

Excerpts: In the distant past, a doctor could build a career practicing medicine in much the same way for decades. But today, with the rapid pace of medical advancement, it means doctors who refuse to adopt new technologies either retire early, find their practices so limited that they cannot effectively compete or fade away into irrelevance.

The technological toolbox available to doctors today is full and growing. Consider just a few of these examples.

Robots allow doctors to perform minimally invasive procedures with greater precision, fewer complications, and faster recovery times. Surgeons control the robot’s every movement, combining human judgment with precision accuracy.

Doctors vs. Real Estate Appraisers

Of course there had to be a correlation to appraisers! In summary, doctors have largely embraced technology, reshaping their profession and improving outcomes for millions of people around the world.

Contrast that with real estate appraisers.

While doctors are saving lives with robotic tools, appraisers are often still clinging to their clipboards, tape measures and manual data entry. While physicians have adopted telemedicine to expand their reach, many appraisers have resisted bifurcation that could streamline valuation processes and bring more work and ultimately more revenue.

To read more, Click Here

My comments: Interesting analysis. A few years ago, I had major surgery where robotics were used. I was worried, but when I research robotics I found out that they can work very well. And that the robots were not doing the surgery! My surgeon determined what the robots did by the surgeon manipulating the surgical instruments in an external device to do the surgery.

UAD 3.6 is coming. Using a tablet app in the field to collect data can really help. What if you don’t want to use an app and want to use a clipboard? I spoke with a software vendor recently who will have paper check lists of what data and photos are needed when using a clipboard.

—————————————————————-

Custom Barndominium ‘Like No Other’ With Hobby Farm and Room for Helipad Hits the Market for $12.5 Million

Excerpts: 4 bedrooms, 3.5+ baths, 6,829 square feet, 31.56acre lot, Built in 2016

An barn-style home—built using architectural elements from the reclaimed wood of New York City water tanks as well as original Boston cobblestones—has hit the market for $12.5 million.

The four-bedroom custom-built compound in Canaan, NY, is known as Pierce Peak and also comes with an equestrian and hobby farm as well as room for a helipad to be built.

The 6,829-square-foot interior boasts a rustic entry with wood-clad walls, sliding barn doors, and a retractable glass wall that opens to the outdoor living area with gas fireplace.

The property also has a lower-level fitness center, two-car garage, built-in fire pit, an infinity-edge pool, outdoor shower, and separate guest quarters designed for both adults and children.

To read more, Click Here

To read the listing with 65 photos and a virtual tour, Click Here

My comments: I keep reading about bardominums, but I have never appraised one or even seen one in my area.

———————————————————

Concessions: Sellers are struggling to listen to the market

By Ryan Lundquist

September 10, 2025

Excerpts:

1) Welcome Back Concessions Amount Field

When the NAR lawsuit happened, the MLS field for the commission amount to the buyer side was removed, but there was also a separate concessions field that was taken away. It was collateral damage from the lawsuit even though the concessions field had nothing to do with compensation. Well, this concessions amount field is thankfully back as of a few weeks ago (thank you Metrolist). Agent friends, PLEASE fill this out because it makes pulling comps helpful for everyone. Knowing what the seller gave the buyer is so important when choosing comps. This field has nothing to do with compensation either. It’s all about stuff like closing costs, credit for repairs, buying down the rate, etc…

2) Sellers Playing Hardball over $9,000

Some sellers are really stubborn right now, and they’re not negotiating with buyers. These sellers are stuck in 2021 thinking they hold all the cards, and they’re not realizing that buyers have more power today. Over the past month, the average concession amount listed in MLS has been $9,168 (or 1.6%). There are obviously much larger concessions in some instances, but on average it’s been pretty minor. In short, some sellers are playing hardball and causing buyers to walk over a minor amount. It’s important to note that we’re in a market where many properties only get one offer (and so many listings have zero offers).

To read more, Click Here

My comments: As usual, this focuses on Ryan’s local market, but you can use his graphs and approaches to handling concessions to analyze your markets. What is happening in your area? If there are concessions this article will help. I know it can be a hassle to get accurate info on concessions, but is important if concessions affect the market in your area.

———————————————————————-

Are you getting too many ad-only emails?

4 ways to get only the FREE email newsletters and NOT the ad-only emails.

1. Twitter: https://twitter.com/appraisaltoday Posted by noon Friday

2. Read on blog www.appraisaltoday.com/blog Posted by noon Friday. You can subscribe to the blog in the upper right of each blog page. NOTE: the popular ads with liability tips are below the first topic on my blog posts.

3. Email Archives: https://appraisaltoday.com/archives

(posted by noon Friday) The link is above and to the left of the big yellow email signup form. Newsletters start with “Newz.” Contains all recent emails sent.

4. Link to the 10 most recent newsletters (no ads) at www.appraisaltoday.com. Scroll down past the big yellow signup block. The newsletters have abbreviated titles, taken from their blog posts.

To read more about the 4 ways, plus information on why I take ads, etc.

——————————————————————

Disability – your greatest risk

In the September, 2024 issue of Appraisal Today

Many appraisers worry about the risk of getting sued on an appraisal, but one of your greatest risks is becoming disabled and unable to work. To appraise at your full capacity, you have to be able to walk, hear, and see.

If disabled, you may be able to continue working, but at reduced capacity.

For example, you may not be able to do field work but you can do desktop appraisals and reviews. But, you may not be able to work at all for a period of time.

Do It Now

Don’t wait. Do it now. I had back surgery in 1988, two years after starting my

business. I was very fortunate – the surgery was successful and I had a full recovery with only 6 weeks off work. I had an office manager and two associate appraisers which really helped. Did I have disability insurance before the surgery? No.

Did I get it later? Yes, but it excluded any back problems.

An appraiser I have known for many years was diagnosed with advanced

breast cancer at the age of 62. Her prognosis was not good and she did not expect to survive very long. She had a 5 year disability policy for a relatively low premium with “own occupation” coverage for appraising and received $2,000 per month until she was 65. It was partial income replacement, but really helped. She survived her cancer and is healthy now. She regularly encourages appraisers to get disability insurance.

Advice from a knowledgeable insurance broker about purchasing disability

insurance

“As a general rule I would suggest that appraisers research disability

insurance thoroughly before purchasing it just as they would any important

insurance product. In addition to reading the policy carefully and asking questions regarding any provisions that are unclear, I recommend finding out as much as possible about a company’s practices with respect to actual claims.”

To read the full article, plus 2+ years of previous issues, subscribe to the paid Appraisal Today at www.appraisaltoday.com/order

Not sure if you want to subscribe?

Sign up for monthly auto renewal for $8.25!

Cancel at any time for any reason! You will receive a prorated refund.

$8.25 per month, $24.75 per quarter, and $89 per year (Best Buy)

or $99 per year or $169 for two years

Subscribers get FREE: past 18+ months of past newsletters

What’s the difference between the Appraisal Today free Weekly email newsletter and the paid Monthly newsletter? Click here for more info.Subscribe to Monthly NewsletterIf you are a paid subscriber and did not receive the

September 2025 issue emailed on Friday, September 2, 2025 please email info@appraisaltoday.com, and we will send it to you. You can also hit the reply button. Be sure to include a comment requesting it.

————————————————————–

Do Nearby Home Sales Affect My Home’s Value?

By Tom Horn

Excerpts: When a nearby home sells, the number tends to get around. Whether it was a fast sale above list price or one that sat on the market with multiple price drops, homeowners pay attention.

That makes sense. After all, most people are curious about what homes are selling for in their neighborhood.

But here’s the thing: not every sale in your neighborhood is a good indicator of what your home is worth. Some are, and some aren’t.

What Appraisers Look For

When we do an appraisal, we don’t just grab the three closest sales and call it a day. We look at how the sales fit into the overall market and consider the small details of the sale.

Here’s what goes into the process:

We search for the most comparable homes that have sold recently.

We make adjustments for differences, things like square footage, home features, or updates.

We consider market trends: Are prices rising, falling, or holding steady?

We look at what’s under contract, not just what has closed. Keep in mind that a house that went under contract yesterday is not as good as one that has the financing squared away, passed the appraisal, and is set to close.

We check listing activity: How fast are homes selling? Are there price cuts?

We also ask: Would a buyer for this home likely consider your home as a reasonable alternative?

To read more, Click Here

My comments: Written for home owners, but useful for appraisers. You can use this article to explain the topic when you get questions from home owners. I frequently get asked about nearby homes that sold or are listed. You can also explain how appraisers select comps. You can also explain how a Pre Listing (from you) appraisal can help.

—————————————————————

The Short-Term Rental Dilemma

by JoAnn Apostol

Excerpts: A couple of years ago, I was having a conversation with some colleagues on short-term rental analysis requests from lenders. One person said that a Certified Residential appraiser should never complete these requests. I held my breath and thought about this for a while and listened to their argument for their position. I also thought to myself, “Have I been doing these all wrong for 20 years?”

After listening to the information presented by the other appraiser, I realized that his work was a going concern assignment. The property was located in an area where the short-term rental properties sold for more than properties that weren’t rented. This remains a likely scenario for an assignment and could require competencies beyond a residential appraiser’s expertise. I continued to have these conversations with different colleagues across the country.

Even in appraising a property to a market value for the fee simple interest, the appraiser should be aware of the impact on price of the personal property or business interest of a short-term rental.

It took a while, but FNMA did finally come out and say that short-term rental income should not be reported on the 1007 form. Does that mean we don’t still get requests to report short-term rental income on the 1007 form? Definitely not! I still get them regularly. There are lenders out there who don’t sell their loans to a Government Sponsored Enterprise. There are also hard money lenders and non-banks that make loans on real estate.

I’ve heard many appraisers flat-out refuse these assignments. I’ve read social media posts arguing that this income shouldn’t be made by appraisers; the reasonings are different in each post. The one consistent theme is the lack of common sense in so many of the conversations.

From the beginning, I was trying to understand if a Certified Residential appraiser could complete these assignments. From all the research I have done, the straightforward, commonsense answer is yes. However, if there is a state law that prohibits it, then the law takes precedence. Think about it for a minute. We hold real estate licenses, and most states don’t license personal or business property appraisers. Therefore, there is nothing that violates our license, or any license.

To read more, Click Here

My comments: The best understandable and practical article, I have read on STRs and residential appraisals. The author speaks from her personal experience. She lives in an area with many STRs and owns one.

————————————————————–

HOW TO USE THE NUMBERS BELOW. Appraisals are ordered after the loan application. These numbers tell you the future for the next few weeks. For more information on how they are compiled, Click Here.

Note: I publish a graph of this data every month in my paid monthly newsletter, Appraisal Today. For more information or get a FREE sample go to www.appraisaltoday.com/order Or call 510-865-8041, MTW, 7 AM to noon, Pacific time.

My comments: Rates are going up and down. We are all waiting for rates to drop in 2025.WASHINGTON, D.C. (September 17, 2025) —

Mortgage applications increased 29.7 percent from one week earlier,

Mortgage applications increased 29.7 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 12, 2025. Last week’s results included an adjustment for the Labor Day holiday.

The Market Composite Index, a measure of mortgage loan application volume, increased 29.7 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 43 percent compared with the previous week. The Refinance Index increased 58 percent from the previous week and was 70 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 3 percent from one week earlier. The unadjusted Purchase Index increased 12 percent compared with the previous week and was 20 percent higher than the same week one year ago.

“Indicative of the weakening job market, and in anticipation of a rate cut from the Federal Reserve, mortgage rates last week dropped to their lowest level since last October, with the 30-year fixed rate declining to 6.39 percent. Homeowners responded swiftly, with refinance application volume jumping almost 60 percent compared to the prior week,” said Mike Fratantoni, MBA’s SVP and Chief Economist. “Homeowners with larger loans jumped first, as the average loan size on refinances reached its highest level in the 35-year history of our survey. Almost 60 percent of applications were for refinances, but there was also a pickup in purchase applications.”

Added Fratantoni, “Even as 30-year fixed rates reached their lowest level in almost a year, more borrowers, and particularly more refinance borrowers, opted for adjustable-rate loans, with the ARM share reaching its highest level since 2008. Notably, ARMs typically have initial fixed terms of five, seven, or ten years, so those loans do not pose the risk of early payment shock that pre-2008 ARMs did. Borrowers who do opt for an ARM are seeing rates about 75 basis points lower than for 30-year fixed rate loans.”

The refinance share of mortgage activity increased to 59.8 percent of total applications from 48.8 percent the previous week. The adjustable-rate mortgage (ARM) share of activity increased to 12.9 percent of total applications.

The FHA share of total applications decreased to 16.3 percent from 18.5 percent the week prior. The VA share of total applications increased to 15.8 percent from 15.3 percent the week prior. The USDA share of total applications decreased to 0.5 percent from 0.6 percent the week prior.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($806,500 or less) decreased to 6.39 percent from 6.49 percent, with points decreasing to 0.54 from 0.56 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The effective rate decreased from last week.

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $806,500) increased to 6.48 percent from 6.44 percent, with points decreasing to 0.35 from 0.48 (including the origination fee) for 80 percent LTV loans. The effective rate increased from last week.

The average contract interest rate for 30-year fixed-rate mortgages backed by the FHA decreased to 6.14 percent from 6.27 percent, with points remaining unchanged at 0.68 (including the origination fee) for 80 percent LTV loans. The effective rate decreased from last week.

The average contract interest rate for 15-year fixed-rate mortgages decreased to 5.63 percent from 5.70 percent, with points increasing to 0.58 from 0.55 (including the origination fee) for 80 percent LTV loans. The effective rate decreased from last week.

The average contract interest rate for 5/1 ARMs decreased to 5.65 percent from 5.77 percent, with points decreasing to 0.41 from 0.63 (including the origination fee) for 80 percent LTV loans. The effective rate decreased from last week.

The survey covers U.S. closed-end residential mortgage applications originated through retail and consumer direct channels. The survey has been conducted weekly since 1990. Respondents include mortgage bankers, commercial banks, thrifts, and credit unions. Base period and value for all indexes is March 16, 1990=100.

———————————————————–

Ann O’Rourke, MAI, SRA, MBA

Ann O’Rourke, MAI, SRA, MBA

Appraiser and Publisher Appraisal Today

1826 Clement Ave. Suite 203 Alameda, CA 94501

Phone: 510-865-8041

Email: ann@appraisaltoday.com

Online: www.appraisaltoday.com

We want to know what you think!! Please leave a comment.