AMCs have been around for a long time. The first AMC, LSI, started in the 1960s. Before HVCC, their market share was an estimated 10-15% of lender residential appraisals. There were relatively few AMCs. Now, there are an estimated over 400-500 AMCs.

I have been writing about AMCs in my paid Appraisal Today newsletter since soon after my first issue in June 1992. In the mid-1990s, when lender business crashed in many areas, some appraisers signed up for AMCs to get work. In those pre-Internet days, often specific forms software and transmission methods were required. Fees were lower than for direct lender work but were stable. There were no broadcast orders, shopping for low fees, or Scope Creep. When business picked up, few appraisers continued to work for them. In my area, there were a few larger appraisal companies who did all the work for specific AMCs.

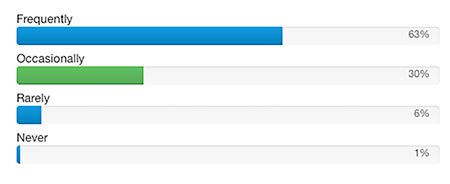

Then HVCC came and most lenders shifted to AMCs to handle their appraisals. Now AMC market share is estimated at over 80%. Fees varied widely. Residential appraisal fees became sensitive to supply and demand. When business was slow, fees went down. When demand for appraisals is high, such as now, fees went up as many appraisers would not work for low fees. Many appraisers, like other business persons, were afraid to turn down work, even with low fees.

Lenders have always wanted fast turn times, to be more competitive and close their loans. Thus, AMCs push for faster turn times.

When working for direct lenders (and mortgage brokers prior to HVCC) appraisers could establish a reputation for accurate and good quality appraisals with their clients. This is still true today with those clients. However, this is not possible with AMCs who have multiple lender clients and ordering that is not done locally and is done by clerks not appraisers.

The greatest change is in the increasing Scope Creep, which has resulted in longer and longer appraisal reports and replying to many questions about appraisals. Unfortunately, much of the additional information does not affect value or make the appraisals more reliable.

Another significant factor is the widespread use of automated review software, including CU, which means that fewer and fewer licensed appraisers are used for reviews.

Even if you don’t work for AMCs, direct lenders are more “picky” but nothing like AMC requirements. Probably because they only manage appraisals for that lender.

Why has this happened? AMCs work for lenders. Lenders tell the AMCs what they want. I suspect that AMCs with multiple clients combine requests from different lenders into one very long engagement letter/list of requirements.

Everyone I have spoken with, from the lender side, says the recent mortgage crash caused lenders to be more concerned about residential appraisals. The previous crash in the late 1980s, the S&L failures, was caused by commercial property loans. There were some changes made to commercial appraisal requirements, but were minor compared with the changes in residential appraisal requirements post-HVCC.

Mortgage lending is a boom and bust business, starting with Fannie and Freddie in the 1970s. They purchased loans from lenders and made refinancing much easier. When interest rates are low, there are lots of loans. When rates are up, loans decline.

Mortgage lending is also boom and bust regarding risk of defaults. Prior to 2008, since the Great Depression, there had never been property value declines that affected the entire country. Statisticians working for lenders, investors, etc. only looked at their data from the past and did not worry about a national meltdown. So, none predicted it. This is, of course, the minus of using statistical data from the past.

What will happen in the future? We will return to the “typical” days of getting mortgage loans with loosened credit requirements. More and more homeowners will not be “underwater” and will be able to refinance. Will residential appraisal “requirements” loosen? No one knows as we have never had so many requirements that keep increasing. Lenders control the requirements. Until they decide that they are causing too many appraisers to quit, want to speed up their loan approval processes, etc. nothing will change. Residential AMC appraisal fees will continue to be cyclical, depending on supply and demand, similar to commercial appraisal fees as long as AMCs are managing appraisals. The less AMCs pay to appraisers, the higher their profits. Maybe lenders will step in and tell AMCs what they must pay their appraisers.

What about direct lenders? There is some scope creep, but not much as compared with AMCs. They don’t shop for the lowest fee. My advice to appraisers is to work for direct lenders whenever possible. Many appraisers with over 20 years of experience still get most of their work from them. When business is slow, they accept AMC work. Another option is to work for AMCs that work for one, or a few, lenders. Then the requirements will not be from a lot of different lenders.

NOW IS THE VERY BEST TIME TO LOOK FOR NEW NON-AMC CLIENTS. WHEN EVERYONE IS BUSY AND TURNING DOWN WORK!! I HAVE SPECIAL REPORTS, LOTS OF MARKETING TIPS FOR NON-AMC LENDER WORK AND ARTICLES ON NON-LENDER WORK IN MY PAID APPRAISAL TODAY NEWSLETTER. www.appaisaltoday.com