Newz: Appraising Basements, AMCs,

Who is doing UAD 3.6 appraisals?

February 20, 2026

What’s in This Newsletter (In Order, Scroll Down)

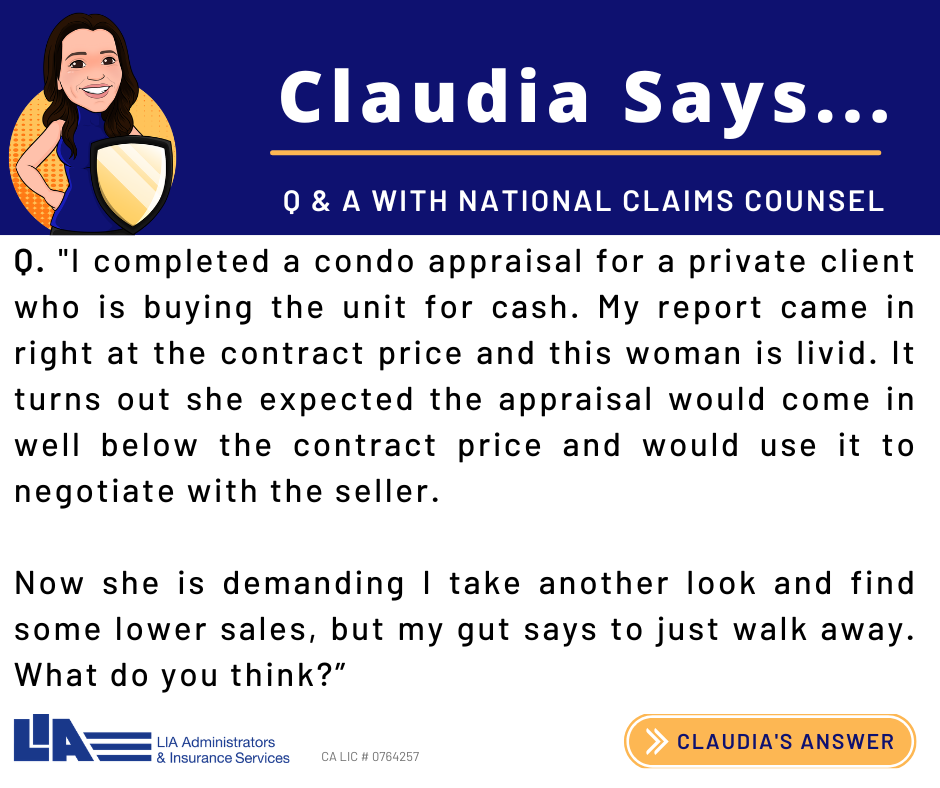

- LIA AD: Limiting Liability to Third Parties

- Basement Appraisals: Understanding Contributory Value (Updated for UAD 3.6)

- Fascinating ‘Basement Home’ That Rises Just Inches Above the Ground Hits the Market for Less Than $160K

- The AMCs: Coming Soon to a Lawsuit Near You

- MY AD: The Cost Approach for Appraisers is not popular, by Tim Andersen, MAI

- 26% of Appraisers Feel Ready: What UAD 3.6 Demand

- Mortgage applications increased 2.8 percent from one week earlier

- Have you received a UAD 3.6 order yet? Survey.

- MBA: Mortgage applications increased 2.8 percent from one week earlier

Click here to subscribe to our FREE weekly appraiser email newsletter and get the latest appraisal news

Basement Appraisals: Understanding Contributory Value (Updated for UAD 3.6)

Excerpts: While homeowners may ask, “Does a finished basement add value to my appraisal?” you know the answer is a bit more complicated. A basement may impact a residential property’s value, and as an appraiser, you’ll need to evaluate its significance.

While determining the contributory value of basements isn’t overly complex, it does pose challenges. To help you out, we’ll outline essential steps and provide tips for evaluating a basement’s contributory value.

Summary

Determining how a basement contributes to a residential property’s value requires an appraiser to identify the basement type, its level of finishing, and any common concerns, like signs of mold or structural issues. Following best practices is key. This includes separating the basement from the above-grade finished area, understanding the intended use of the space, and completing comprehensive market research. By doing so, you can evaluate the basement’s contributory value more accurately

Topics include:

Types of basements (partial list)

Cellars

Partial Basements

Walk-Up Basements

How Is the Basement Finished? Determining Levels

Know the Intended Use and Client Requirements

To read more, Click Here

My comments: The best analysis and advice on basements I have seen. Watch the 7 minute video on Understanding Q/C ratings (UAD 3.6) Where I work the ground does not freeze. In my Island city there is no cemetery as the ground water from San Francico Bay is very high. Basements need pumps to remove salt water. Basement walls are not used to support the home. Sometimes there are above ground basements, basements dug out of the ground, and many other types of basements. In steep hillside areas what is a “basement” can be controversial.

In Alameda, my city, native American burials, primarily from the Ohlone people, are heavily concentrated in former shellmounds (ancient cemeteries) throughout Alameda. Almost were removed many years ago, similar to other Bay area cities close to the Bay.