|

Adjustments – “Support” vs. “Proof, what should you do?

New in the FEBRUARY 2016 issue of the paid Appraisal Today

– Adjustments Part 1 – Are you making too many adjustments? Lots of ideas, research, etc.

– Support vs. proof for adjustments by Bob Keith. A very good explanation of Scope Creep on adjustments. He is the former Executive Director

of the Oregon State Appraisal Board and is a consultant for appraisers with state board complaints

– Identifying Residential Architectural Styles by Mark Nadeau,SRA, Book review. Read my review to decide if you want to buy the book.

– Two good, practical residential books, with very good tips on adjustments Book reviews.

– The Dictionary of Real Estate Appraisal, 6th Edition – Read my review to decide if you want to buy this book.

Cancel at any time. For any reason!!

$8.25 per month, $24.75 per quarter, $89 per year (credit card only),

or $99 per year or $169 for two years (no credit card required)

Subscribers get, FREE: past 18+ months of newsletters plus 4 Special Reports!!

If you are a paid subscriber and did not get the January 2016 issue, emailed Jan. 4, 2016, please send an email to info@appraisaltoday.com requesting it and we will send it to you!! Or, hit the reply button. Be sure to put in a comment requesting it ;>

==============================================================

Fannie, Freddie Unveil New Appeals Process for Loan Repurchases

Excerpt:

Fannie Mae and Freddie Mac unveiled an appeals process Tuesday that will allow an independent arbitrator to resolve disputes between lenders and the government-sponsored enterprises over loan repurchase demands.

The new independent dispute resolution process, which was approved by the Federal Housing Finance Agency and endorsed by the Mortgage Bankers Association, is an effort to provide lenders more certainty that they won’t later face costly repurchase requests if a loan goes bad.

http://www.nationalmortgagenews.com/news/secondary/fannie-freddie-unveil-new-appeals-process-for-loan-repurchases-1071121-1.html

My comment: Maybe lenders will be less paranoid about appraisals causing buybacks and cut back on Excessive Appraisal Requirements.

——————————

One-third of realty transactions are plagued by delays, some of them fatal By Ken Harney

Excerpt:

According to the study, of the 32 percent that experienced delays, 46 percent were triggered by “financing issues,” which is up from 40 percent during the first half of 2015. Appraisal-related problems caused 21 percent of the delays and home-inspection issues in 14 percent. Of the nearly 1 of every 16 (6 percent) of deals that turned into total disasters and fell through, home inspection and financing were the primary culprits. Sixteen percent went south because of the appraisal.

https://www.washingtonpost.com/realestate/one-third-of-realty-transactions-are-plagued-by-delays-some-of-them-fatal/2016/01/19/0d74d684-beb9-11e5-83d4-42e3bceea902_story.html

My comment: maybe that’s why some AMCs are pressuring/asking for more when you “come in” under the sales price. Their clients, the lenders, don’t like deals falling through…

—————————————-

Study finds discrepancies between reported and actual home sales prices By Ken Harney

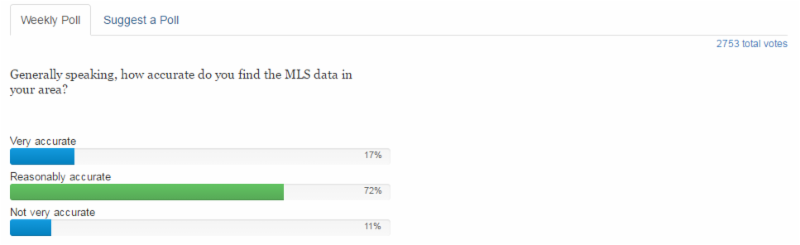

Are some realty agents hyping the pricing information on closed sales they report to their local multiple listing service, or MLS? And if so, should you care?

A first-of-its-kind study by appraisal and real estate experts suggests that maybe they are and maybe you should. Researchers compared closing documents – which are supposed to indicate the final price in sales transactions – with the prices that agents actually reported to their MLS and found that in nearly 1 of every 11 cases (8.75 percent) there were discrepancies. Overstatements of final price exceeded understatements by a ratio of nearly 3 to 1. In one case, the price reported to the MLS was 21.4 percent above the actual closing price.

https://www.washingtonpost.com/realestate/study-finds-discrepancies-between-reported-and-actual-sales-prices/2016/01/26/86d11660-c435-11e5-a4aa-f25866ba0dc6_story.html

My comment: And AMCs worry about discrepancies on public records and appraisers on GLA!! Another reason Big Data (CU) fails and needs appraiser input.

———————————————————–

HOW TO USE THE NUMBERS BELOW. Appraisals are ordered after the loan application. These numbers tell you the future for the next few weeks. For more information on how they are compiled, go to www.mbaa.org

Note: I publish a graph of this data every month in my printed newsletter, Appraisal Today. For more information or get a FREE sample issue go to www.appraisaltoday.com/products.htm or send an email to info@appraisaltoday.com . Or call 800-839-0227, MTW 8AM to noon, Pacific time.

Mortgage applications decreased 2.6 percent from one week earlier

WASHINGTON, D.C. (February 3, 2016) – Mortgage applications decreased 2.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending January 29, 2016. The previous week’s results included an adjustment for the Martin Luther King holiday.

The Market Composite Index, a measure of mortgage loan application volume, decreased 2.6 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 11 percent compared with the previous week. The Refinance Index increased 0.3 percent from the previous week to its highest level since October 2015. The seasonally adjusted Purchase Index decreased 7 percent from one week earlier. The unadjusted Purchase Index increased 11 percent compared with the previous week and was 17 percent higher than the same week one year ago.

The refinance share of mortgage activity increased to 59.2 percent of total applications from 59.0 percent the previous week. The adjustable-rate mortgage (ARM) share of activity decreased to 5.9 percent of total applications.

The FHA share of total applications increased to 12.9 percent from 12.7 percent the week prior. The VA share of total applications remained unchanged from 11.1 percent the week prior. The USDA share of total applications remained unchanged from 0.7 percent the week prior.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to its lowest level since October 2015, 3.97 percent, from 4.02 percent, with points increasing to 0.41 from 0.40 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. This is the fourth straight weekly decrease for this rate. The effective rate decreased from last week.

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $417,000) decreased to its lowest level since April 2015, 3.84 percent, from 3.89 percent, with points increasing to 0.26 from 0.25 (including the origination fee) for 80 percent LTV loans. This is the fourth straight weekly decrease for this rate. The effective rate decreased from last week.

The average contract interest rate for 30-year fixed-rate mortgages backed by the FHA decreased to 3.80 percent from 3.83 percent, with points decreasing to 0.35 from 0.38 (including the origination fee) for 80 percent LTV loans. The effective rate decreased from last week.

The average contract interest rate for 15-year fixed-rate mortgages decreased to 3.22 percent from 3.28 percent, with points remaining unchanged at 0.37 (including the origination fee) for 80 percent LTV loans. The effective rate decreased from last week.

The average contract interest rate for 5/1 ARMs decreased to 3.00 percent from 3.09 percent, with points remaining unchanged at 0.34 (including the origination fee) for 80 percent LTV loans. The effective rate decreased from last week

The survey covers over 75 percent of all U.S. retail residential mortgage applications, and has been conducted weekly since 1990. Respondents include mortgage bankers, commercial banks and thrifts. Base period and value for all indexes is March 16, 1990=100

|