The Oldest Living Things in the World

Fifteen places to find some of the most ancient life on Earth.

Just For Fun ;>

Just For Fun ;>

Are you paying unseen add-on fees for your appraisal?By Ken Harney, nationally syndicated real estate writer

Excerpt: Are you getting fleeced on appraisal charges when you buy a house or refinance? Could you be paying as much as double what the appraiser is receiving for actually doing the work, with the excess going to an undisclosed third party?

Why are barns painted red and the White House white?

To register,click here:

|

$8.25 per month, $24.75 per quarter, $89 per year (Best Buy)

or $99 per year or $169 for two years

Subscribers get, FREE: past 18+ months of past newsletters

plus 4 Special Reports, plus 2 Appraiser Marketing Books!!

|

|

To purchase the paid Appraisal Today newsletter go to

www.appraisaltoday.com/products or call 800-839-0227.

|

I have been writing about non-lender work since 1992 in my paid Appraisal Today newsletter.

——————————————————————–

——————————————————————–The Market Composite Index, a measure of mortgage loan application volume, increased 3.3 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 16 percent compared with the previous week. The Refinance Index increased 5 percent from the previous week to the highest level since December 2016. The seasonally adjusted Purchase Index increased 2 percent from one week earlier. The unadjusted Purchase Index increased 15 percent compared with the previous week and was 4 percent higher than the same week one year ago.

The refinance share of mortgage activity increased to 45.4 percent of total applications from 45.1 percent the previous week. The adjustable-rate mortgage (ARM) share of activity increased to 7.7 percent of total applications to the highest level since October 2014. The average loan size for purchase applications reached a survey high at $313,300.

The FHA share of total applications decreased to 11.8 percent from 12.3 percent the week prior. The VA share of total applications decreased to 11.6 percent from 11.7 percent the week prior. The USDA share of total applications remained unchanged at 0.9 percent from the week prior.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) increased to 4.36 percent from 4.30 percent, with points increasing to 0.44 from 0.38 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The effective rate increased from last week.

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $424,100) increased to 4.27 percent from 4.23 percent, with points increasing to 0.26 from 0.25 (including the origination fee) for 80 percent LTV loans. The effective rate increased from last week.

The average contract interest rate for 30-year fixed-rate mortgages backed by the FHA increased to 4.18 percent from 4.07 percent, with points decreasing to 0.32 from 0.37 (including the origination fee) for 80 percent LTV loans. The effective rate increased from last week.

The average contract interest rate for 15-year fixed-rate mortgages increased to 3.57 percent from 3.51 percent, with points remaining unchanged at 0.36 (including the origination fee) for 80 percent LTV loans. The effective rate increased from last week.

The average contract interest rate for 5/1 ARMs increased to 3.48 percent from 3.35 percent, with points decreasing to 0.20 from 0.29 (including the origination fee) for 80 percent LTV loans. The effective rate increased from last week.

The survey covers over 75 percent of all U.S. retail residential mortgage applications, and has been conducted weekly since 1990. Respondents include mortgage bankers, commercial banks and thrifts. Base period and value for all indexes is March 16, 1990=100.

Haunting Photos of Europe’s Abandoned Buildings, From Steel Plants to Castles

FHA handbook 4000.1 quarterly update

The Most Unusual Homes Available Right Now, for sale or for rent, From A Luxury Cave To A Giant Turtle

Excerpt:

Good investment or not, wacky homes sure are fun to look at and can be rewarding to owners in ways more profound than money (more on that below). So we went in search of some of the most interesting homes available today. We found a house shaped like an onion, an Irish castle and a home meant to look like a fishing reel.

My comment: Just For Fun!! I wanna rent one of the vacation rentals. The Turtle House in Egypt is only $54 to $96 per night!! And you thought some of the weirdo homes you appraised were strange… take a look at these! And, of course, Ace Appraiser Jonathan Miller is mentioned in the first paragraph ;>

—————————

What is your current appraisal turn time (order receipt to submission)?

My comment: I wonder how many are over 2 weeks? 8 weeks?

WHAT DO YOU THINK? POST YOUR COMMENTS AT www.appraisaltodayblog.com !!

—————————

Viginia Coalition of Appraiser Professionals (VaCap) Open Letter to AMCs

A few weeks ago, Virginia Coalition of Appraiser Professionals (VaCAP) sent out an open letter to the AMCs. This letter was republished by many coalitions, and appraiser groups across the country; liked and shared on Facebook and broadcast on several industry blogs. VaCAP received an overwhelmingly positive response from the letter. We even heard from several Realtors applauding our efforts! Activity is still ongoing with comments! Click here to read the letter and comments!

We heard you loud and clear…

The letter can now be signed by individual appraiser here on AppraisersBlogs. We will gather signatures and submit the signed letter to the FDIC, CFPB, Comptroller of the Currency and our Federal Reserve Board.

Note: To protect the appraiser identity from retaliation, only the initial of your last name and state will show on line. The copies sent to the FDIC, CFPB, Comptroller of the Currency and our Federal Reserve Board will have your full name.

Excerpt of a few points on the list:

My comment: I usually don’t put in links to negative blog posts, but this seems to hit all the AMC issues, plus has something you can do. AMCs have been around since the 1960s but were never like this before. It is definitely a Big Mess and bad for the consumer (higher appraisal fees, delays in getting loans, etc.) Of course, they are doing what their lender clients want, but their methods are not good. There are some AMCs that are okay. Some appraisers have found a few they work for. Note: There is an ad in the middle of the post.

http://appraisersblogs.com/appraisers-sign-vacap-amc-letter/

——————————

Fees are going way up!! How to get higher appraisal fees during this boom time!! By Ann O’Rourke, MAI, SRA, PDQ and Doug Smith, SRA, AI-RRS . Lots and lots of practical tips.

Excerpt from the article:

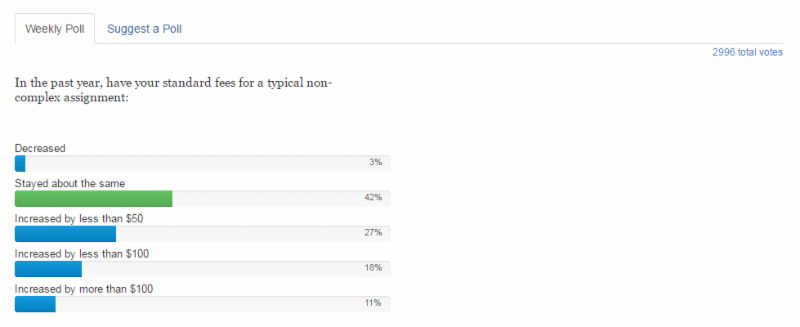

How many appraisers are raising their fees?

I have been telling appraisers to raise their fees since early 2015. Below are two results of

appraisalport weekly polls.

Results from an April 2015 AppraisalPort weekly poll

Question: How long has it been since the last time you actually raised your fees?

Back in April 2015 not many appraisers were raising their fees.

In the past year, have your standard fees for a typical non-complex assignment changed?

Results from Appraisalport September 2016 poll.

More appraisers are raising their fees in 9/16, but 45% have not still raised their fees! A few years ago I raised my non-lender fees to close to what borrowers pay. Why do appraisers keep working for low fees when they are so busy that they can’t take any more work? Or, they are not super busy, but want to get higher fees? Fear of never getting any more work. This is common to almost every business person, including myself. But it is not good when it keeps you from making more money, as it always does.

$8.25 per month, $24.75 per quarter, $89 per year (Best Buy)

or $99 per year or $169 for two years

Subscribers get, FREE: past 18+ months of past newsletters

plus 4 Special Reports, plus 2 Appraiser Marketing Books!!

————————————————–

17 Things Appraisers Should Do Before Hiring an AMC Client

October 4th, 2016 9:54 AM

Here are two of them:

7. Google the AMC’s name and see what comes up. This might seem obvious, but some AMCs have been in the news for lawsuits related to unfavorable treatment of appraisers. You do not want to waste your time vetting an AMC that has a bad reputation. Even if no lawsuits come up, a quick Google search could result in a feel for the company and let you know if this is a company you want to work for. Remember that homeowners might think you work for this AMC when you show up to do the appraisal. Is this a company that you are okay with if homeowners get confused and think you work for them?

17. Check the AMC’s data protection policy and ask what steps have been taken to keep your private information safe. Also ask if the AMC has ever had any data breaches and if so, determine what systems have been put into place to ensure that data breaches do not happen again. Does the AMC have a policy that requires them to alert appraisers if they believe a data breach was possible?

Click here for the full Most Excellent List!!

www.aqualityappraisal.com.blog

——————————————–

AMC Notes from Appraiserville by Jonathan Miller

Excerpts:

There was a CNBC article this week by Diana Olick that caused an uproar in the appraisal industry: ‘Massive’ shortage of appraisers causing home sales delays. Besides the incorrect inference of the title, the article was centered around Brian Coester, CEO of the Maryland-based CoesterVMS, currently one of the most controversial personalities in the appraisal management industry…

So I spoke with Diana Olick about the article this morning. I’ve known her for a long time and read all her stuff. She clearly did not realize what CoesterVMS represents to the appraisal industry but learned this from the outpouring of negative comments on the article by outraged appraisers. She understands now. How great is it that appraisers are getting out there and speaking their mind!

I told her that Coester is a notorious AMC in the middle of a big lawsuit that the entire appraisal industry is following. The shortage of appraisers is a myth being perpetuated by AMCS like Coester since their model only works if they pay appraisers a third to half the market rate for appraisal services.

My comment: I definitely think the current AMC model is broken, from the consumer, lender, appraisal and appraiser sides. I don’t really understand how it got so bad. I started writing in my paid newsletter about AMCs in the early 1990s. AMCs started in the were never like this before. Mostly they just paid lower fees. None had really low fees, scope creep, harassing and demeaning appraisers, etc.

To read more, Scroll down the page to Appraiserville

http://www.millersamuel.com/note/september-30-2016

—————————-

Miller was on a recent Voice of Appraisal radio interview with Phil Crawford.

Miller’s interview starts at -25:09 or 17:20 (download) 43:31 minutes total

http://www.voiceofappraisal.com/podcasts Episode 123

My comment: In last week’s email newsletter I said that the 2016 peak is almost up to the 2013 peak. In 2013 no one was complaining about high fees and turn times. In their discussion Miller said it was different because of CU/Scope Creep. He also said that business had been very slow between 2008 and 2012 and appraisers were glad for work. Appraiser attitudes about working for AMCs is much, much worse now. Good comments…Very few appraiser complaints about direct lenders and non-lender work.

————————————

Revised FHA handbook

Thanks to Dave Towne for this info!

HUD/FHA recently updated and revised the 4000.1 Handbook…..actually on June 30, 2016………..but notice about this was sent out Friday, Sept. 30.

http://portal.hud.gov/hudportal/HUD?src=/program_offices/housing/sfh/handbook_4000-1

When the page opens, scroll down the page and you’ll see two entries on the left regarding the Handbook. If you open the PDF link, and let it load…it will actually show you the changes made to the appraisal section (and others).

Note….the handbook is 1000+ pages, but only about 40 or so apply to appraisals.

Note that the revised handbook has ‘moved’ the Appraiser and Property Requirements section to II D, from its former position in B.

Buried in the revision is new info on how to account for specific named ‘appliances’ in a home you are appraising. See II D 3e.

It’s going to take someone with more time (than I have now) and expertise to determine what exactly HUD changed in the reporting requirements about “appliances that remain and contribute to value.” One needs to read the former 4000.1 Handbook and compare that to this revised edition to fully understand the implications of what HUD wants reported.

You will want to compare the attic observation requirement also. Revision 4000.1 has this in II D 3k.

Crawl space observation is in II D 3m.

————————————————-

HOW TO USE THE NUMBERS BELOW. Appraisals are ordered after the loan application. These numbers tell you the future for the next few weeks. For more information on how they are compiled, go to https://www.mba.org

Note: I publish a graph of this data every month in my printed newsletter, Appraisal Today. For more information or get a FREE sample issue go to www.appraisaltoday.com/productsor send an email to info@appraisaltoday.com . Or call 800-839-0227, MTW 8AM to noon, Pacific time.

WASHINGTON, D.C. (October 5, 2016)

Mortgage applications increased 2.9 percent from one week earlier

according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 30, 2016.

The Market Composite Index, a measure of mortgage loan application volume, increased 2.9 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 3 percent compared with the previous week. The Refinance Index increased 5 percent from the previous week. The seasonally adjusted Purchase Index decreased 0.1 percent from one week earlier. The unadjusted Purchase Index decreased 0.2 percent compared with the previous week and was 14 percent lower than the same week one year ago.

The refinance share of mortgage activity increased to 63.8 percent of total applications from 62.7 percent the previous week. The adjustable-rate mortgage (ARM) share of activity increased to 4.5 percent of total applications.

The FHA share of total applications decreased to 10.0 percent from 10.2 percent the week prior. The VA share of total applications decreased to 11.4 percent from 11.9 percent the week prior. The USDA share of total applications increased to 0.7 percent from 0.6 percent the week prior.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 3.62 percent, the lowest level since July 2016, from 3.66 percent, with points decreasing to 0.32 from 0.33 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The effective rate decreased from last week.

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $417,000) decreased to 3.60 percent from 3.64 percent, with points decreasing to 0.25 from 0.28 (including the origination fee) for 80 percent LTV loans. The effective rate decreased from last week.

The average contract interest rate for 30-year fixed-rate mortgages backed by the FHA decreased to 3.50 percent from 3.52 percent, with points decreasing to 0.16 from 0.21 (including the origination fee) for 80 percent LTV loans. The effective rate decreased from last week.

The average contract interest rate for 15-year fixed-rate mortgages decreased to 2.93 percent from 2.95 percent, with points decreasing to 0.32 from 0.38 (including the origination fee) for 80 percent LTV loans. The effective rate decreased from last week.

The average contract interest rate for 5/1 ARMs remained unchanged at 2.92 percent, with points increasing to 0.44 from 0.40 (including the origination fee) for 80 percent LTV loans. The effective rate increased from last week.

The survey covers over 75 percent of all U.S. retail residential mortgage applications, and has been conducted weekly since 1990. Respondents include mortgage bankers, commercial banks and thrifts. Base period and value for all indexes is March 16, 1990=100.

The Revolutionary Concept of Standard Sizes Only Dates to the 1920s

Nearly everything in your home is a certain size, thanks to German architect Ernst Neufert.

Excerpt: Almost every kitchen counter in the United States is 36 inches tall. And 25 inches deep. Eighteen inches above the counters are the cabinets, which are 16 inches deep.

Where do these sizes and dimensions come from? Have they always been so exact?

Building standards, as these numbers and rules are often known, are everywhere, helping shape everything from your kitchen cabinets and the sidewalk in front of your house to the layout of your favorite restaurant. Despite their prevalence, building standards really only came into being in the last century. A major turning point in their wild proliferation arrived in the 1920s, when the German government made the then-radical decision to standardize the size of office paper.

My comment: Fascinating!! Lots more info and images at the link below.

———————————————-

Do you have questions about using Collateral Underwriter® (CU™)? Register to attend the upcomingAsk the Expert webinar on September 27, 2 p.m. to 3 p.m. ET. Additional webinars and eLearning courses are available on the CU web page.

Have you heard about CU’s easier-to-use design and layout coming later this year? Check out the preview. You can also view the new CU infographic for an overview of CU’s powerful features. CU gives you the feedback you need, when you need it, with a CU risk score, alerts, and messages provided real-time in the Uniform Collateral Data Portal® (UCDP®). For all the latest news and resources, visit the CU web page.

———————————-

Scheer Motion to Dismiss Coester vs Scheer Lawsuit

Excerpt: More CVMS Fraud and Coester’s Fraudulent Activities Revealed

Robert Scheer, former Coester Senior VP, has filed a motion to dismiss Coester vs. Scheer lawsuit. There are also whispers in the appraisal community that Brian Coester’s motion to dismiss the lawsuit against him was denied. Looks like Scheer vs. Coester lawsuit is going to trial. Scheer continues to reveal more dirt against Coester while appraisers continue to flood social media with comments, and sometimes with humorous reactions…

This article includes the motion to dismiss.

http://appraisersblogs.com/cvms-fraud-coester–scheer

Previous post on this topic: Coester Allegedly Engaged in Fraud Sued by Former Senior VP

http://appraisersblogs.com/Coester-VMS-lawsuit-fraud-forgery

———————————–

Dollhouse Real-Estate: Inside the Elite Market for Miniature Homes

Priced as high as hundreds of thousands of dollars, these elaborate dollhouses count sex therapist Ruth Westheimer and a member of Qatar’s royal family as collectors

Excerpt: This Victorian-style home features four bedrooms, one bathroom and ornate period details like a clawfoot bathtub, crystal chandeliers and mahogany fireplaces. It is currently on the market, fully furnished, for $149,000. Since the home is roughly 18 square feet, the price comes to about $8,278 per square foot.

My comment: Thanks to Jonathan Miller for this Fun Link!!

Doll houses will never be the same for me ;>

=============================================

Topics include:

To read the full article, plus 2+ years of previous issues, subscribe to the paid Appraisal Today.

$8.25 per month, $24.75 per quarter, $89 per year (Best Buy)

or $99 per year or $169 for two years

Subscribers get, FREE: past 18+ months of past newsletters plus 4 Special Reports, plus 2 Appraiser Marketing Books!!

If you are a paid subscriber and did not get the September 2016 issue, emailed September 1, 2016, please send an email to info@appraisaltoday.com and we will send it to you!! Or, hit the reply button. Be sure to put in a comment requesting it ;>

——————————————–

APPRAISERS IN THE NEWS. THE ARTICLES BELOW ARE ABOUT FEES, TURN TIMES, APPRAISER SHORTAGE, ETC. THEY WERE WRITTEN FOR LENDERS, REAL ESTATE AGENTS, HOME OWNERS, AND THE GENERAL PUBLIC. All allow comments, which can be very interesting!!

5 things to consider about higher appraisal fees and longer turn-times By Ryan Lundquist. Written for real estate agents and home owners

Excerpt: 4) Not Getting All the Money: A loan officer I spoke with was frustrated that his Borrowers were paying $550 for conventional appraisals and $750 for jumbo appraisals – and still experiencing longer turn-times. When he told me the Appraisal Management Company (AMC) he uses though, that’s where the problem comes in. This AMC regularly pays appraisers $350, which means they’re pocketing 40% of the fee the Borrower thinks is going to the appraiser. A few days ago on Facebook there was an appraiser who had an offer from an AMC to appraise a property for $850, but the AMC was charging the Borrower $1,385. Let’s remember appraisers are supposed to be paid “customary and reasonable” fees under Dodd-Frank, but a reasonable fee is what the appraiser gets – NOT what the Borrower pays.

My comments: Well written – for real estate agents and home owners, but has good explanations for everyone. (Ryan’s blog is primarily marketing for his appraisal business.) This article also discusses the decline in the number of appraisers in California, with data, but is relevant for many other states.

———————————-

Appraiser Shortage? By Greg Stephens, SRA, MetroWest AMC

Reprinted from a June 2016 mortgage magazine. Written for lenders.

Excerpt: A topic very relevant to mortgage professionals has been receiving increasing attention lately-the question whether there is or is not a shortage of appraisers? Regulators, as well as market participants, have been weighing in, and depending upon who you talk to, the answers vary. The problem so far is that most of the discussion has been anecdotal.

What also needs to be included in stakeholder discussions on the topic is the status of future appraisers in the pipeline to replace the aging population of practicing appraisers.

To answer the question-not only whether there is a current shortage, but also if there is the potential for a shortage either in the near future (three to five years) or perhaps even longer, I conducted some in-depth research to glean as much factual information as possible.

My comments: This article has some good data on declines in number of trainees, problems with ASC data,lenders not allowing trainees to sign on their own, etc. Written for mortgage lender publication. Of course, it does not discuss low fees, scope creep, and treating appraisers “poorly” as a reason for the shortage of appraisers willing to work for many, or all, AMCs.

http://www.nationalmortgageprofessional.com/news/60306/appraisal-industry-update

————————————————————–

Need an appraisal right away? It may cost more than you’d expect. By Ken Harney. Written for the general public. Syndicated in national newspapers.

Excerpt: The problem is part work overload, part resentment over fees. In many markets, diminishing numbers of experienced appraisers are available – and willing – to handle requests for their work on tight timetables and at fees sometimes lower than they earned a decade or more ago.

The net result: The system is getting gummed up. …. A recent survey of agents by the National Association of Realtors found that appraisal problems were connected with 27 percent of delayed closings, up from 16 percent earlier this year.

In some cases, panicked lenders and management companies are offering appraisers fat bonuses and “rush fees” to meet deadlines. The extra charges can range from $200 to $1,000 or more, turning $500 appraisals into $1,200 or $1,500 expenses, which typically get paid by home buyers.

My comment: Harney has been a nationally syndicated real estate columnist for a long time.

————————————————-

HOW TO USE THE NUMBERS BELOW. Appraisals are ordered after the loan application. These numbers tell you the future for the next few weeks. For more information on how they are compiled, go to https://www.mba.org

Note: I publish a graph of this data every month in my printed newsletter, Appraisal Today. For more information or get a FREE sample issue go to www.appraisaltoday.com/productsor send an email to info@appraisaltoday.com . Or call 800-839-0227, MTW 8AM to noon, Pacific time.

WASHINGTON, D.C. (September 21, 2016)

Mortgage applications decreased 7.3 percent from one week earlier,

according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 16, 2016. The prior week’s results included an adjustment for the Labor Day holiday

The Market Composite Index, a measure of mortgage loan application volume, decreased 7.3 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 15 percent compared with the previous week. The Refinance Index decreased 8 percent from the previous week to the lowest level since June 2016. The seasonally adjusted Purchase Index decreased 7 percent from one week earlier. The unadjusted Purchase Index increased 15 percent compared with the previous week and was 3 percent higher than the same week one year ago.

The refinance share of mortgage activity increased to 63.1 percent of total applications from 62.9 percent the previous week. The adjustable-rate mortgage (ARM) share of activity decreased to 4.4 percent of total applications.

The FHA share of total applications increased to 10.2 percent from 9.6 percent the week prior. The VA share of total applications decreased to 11.6 percent from 12.0 percent the week prior. The USDA share of total applications remained unchanged from 0.7 percent the week prior.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to its highest level since June 2016, 3.70 percent, from 3.67 percent, with points increasing to 0.38 from 0.36 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The effective rate increased from last week.

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $417,000) increased to 3.69 percent from 3.64 percent, with points decreasing to 0.29 from 0.36 (including the origination fee) for 80 percent LTV loans. The effective rate increased from last week.

The average contract interest rate for 30-year fixed-rate mortgages backed by the FHA increased to 3.56 percent from 3.50 percent, with points decreasing to 0.23 from 0.27 (including the origination fee) for 80 percent LTV loans. The effective rate increased from last week

The average contract interest rate for 15-year fixed-rate mortgages increased to 2.99 percent from 2.97 percent, with points increasing to 0.35 from 0.34 (including the origination fee) for 80 percent LTV loans. The effective rate increased from last week.

The average contract interest rate for 5/1 ARMs increased to 2.96 percent from 2.87 percent, with points

decreasing to 0.26 from 0.37 (including the origination fee) for 80 percent LTV loans. The effective rate increased from last week.

The survey covers over 75 percent of all U.S. retail residential mortgage applications, and has been conducted weekly since 1990. Respondents include mortgage bankers, commercial banks and thrifts. Base period and value for all indexes is March 16, 1990=100.

A Map of the Last Remaining Flying Saucer Homes

All the 1960s Futuro Houses left in the world.

Just For Fun!! Take a break from writing up those darn appraisal reports ;>

Excerpt: The Futuro House, in all its space age retro splendor, is like a physical manifestation of 1960s optimism. Shaped like the Hollywood idea of a flying saucer, the Futuro is a plastic, prefabricated, portable vacation home built to easily adapt to any climate or terrain, from mountain slopes to the seaside. After enjoying a heyday in the late ’60s and early ’70s, the remaining Futuros are now scattered across all parts of the globe, from the Australian beaches to the mountains of Russia, like secluded relics of midcentury technoutopianism.

Very interesting!!

http://www.atlasobscura.com/articles/a-map-of-the-last-remaining-flying-saucer-homes

My comment: I love atlasobscura.com. The strange homes and buildings I include in these emails are just the tip of the iceberg!!!!

——————

What is your typical rush fee?

www.appraisalport.com poll.

My comment: Rush fees are another way to make more money during this boom time, to save for the downturn when AMC fees will drop.

The most critical appraisals are those for purchases, which can require rush fees to get appraisers to drop their regular refi business and do them.

I am hearing about widely varying AMC fee increases from around the country, depending on the local market supply of appraisers willing to work for AMCs I guess. Savvy AMC appraisers reply to low bids with an increased fee. After a few weeks, sometimes their fee is accepted. Local appraisers I know only work for a very few select AMCs, if any. But, when business slows way down, they take more AMC work. I also hear from appraisers in the same market with widely varying fees that they will accept.

What do I do? Rush fees stress me out too much as I am very backed up. I just put new appraisal requests in my queue, which is typically around 60 days. Sometimes I will do one faster if it is a special circumstance and/or a referral from a local real estate agent, but I don’t require a rush fee. When I used to do appraisals for purchases, I always gave them priority but never charged a rush fee. I am definitely in the minority!!

What do you think? Post your comments at https://wp.me/p7jsxG-Cl !!!

——————————————

The Most Expensive House In The World Could Sell For $1.1 Billion

Just For Fun!! Take a break from writing up those darn appraisal reports ;>

Excerpt: What can justify a $1.1 billion price tag for a house?

Before searching for the features behind the number, let’s clarify that in this case, “the house” is rather a large, opulent mansion on the French Côte d’Azur, set in a “small” privileged refuge between Nice and Monaco frequently described as the ‘billionaires’ playground.’

First, there’s the house itself, with the understated name Villa Les Cèdres-The Cedars-at the center of Saint-Jean-Cap-Ferrat, known in French as a “presqu’île,” or “almost island.”

The description of the magnificent property in the French press includes 10 bedrooms, a ballroom, concierge, a chapel, 50-meter swimming pool dug into the rocks, a winter garden and stables for 30 horses.

My comment: I could take a few months (or more) to do an appraisal for a trip to France to appraise this property… Or maybe just an open house tour ;>

Very interesting!!

————————————

Beware of unknown desperate AMCs sending email solicitations

An appraiser I know, who only works for one AMC, received an email request from an AMC he had never heard of. He replied politely that he was not interested. He was added to their approved list and bombarded with requests for appraisals every day. It was a lot of hassle to get his name removed.

I seldom get any AMC appraisal requests by email or phone, or request to join their panel. I must be on a Do Not Call or Email List ;> I have been replying to emails saying I have never worked for an AMC. They are really getting desperate!! Now, I am thinking about not even replying.

==========================================

Excerpt: Inspection Tips – Insulation and attic access by Doug Smith, SRA, AI-RRS

When blown in insulation is added, the installer will often add an extension or dam to the scuttle that makes it difficult to fully observe the full attic.

Formerly, attics had walkways which when blown in insulation is applied, these walkways were covered with insulation. If the scuttle is in a closet and closet shelves make it difficult to fully access the attic, the difficulty with attic must be reported and a photograph taken to demonstrate the difficulty with attic access.

However, if the access is blocked by personal possessions, it may be practical to enlist the help of the homeowner to make the attic or scuttle accessible. In the instant case of the underwriter stating that a full inspection is required, the underwriter is incorrect.

The appraiser must document why a full inspection was not performed when there is not an accessible attic. Suggested language might include: “A full attic inspection was not

performed as the subject property does not have a readily accessible attic and only has scuttle access.” Along with a photo of what can be seen from the scuttle, the appraiser might add that the appraiser completed a head and shoulders inspection of the attic.

Remember to check the block on page one of the form that the attic is accessed by a scuttle. If the property has a full attic, note if a full inspection was performed and comment how access was gained either by stairway or drop stair.

$8.25 per month, $24.75 per quarter, $89 per year (Best Buy)

or $99 per year or $169 for two years

Subscribers get, FREE: past 18+ months of past newsletters

plus 4 Special Reports, plus 2 Appraiser Marketing Books!!

If you are a paid subscriber and did not get the September 2016 issue, emailed September 1, 2016, please send an email to info@appraisaltoday.com and we will send it to you!! Or, hit the reply button. Be sure to put in a comment requesting it ;>

=====================================================

Selling a $5 Million, Seven-Story Basket Is No Picnic

Its size, location, and fundamental basket-ness make it tough to sell, even at a steep discount

Thanks (again) to Jonathan Miller at http://www.millersamuel.com/housing-notes/

Excerpts: “You might see it three or four miles off before you come around the bend, and then you say, ‘That is a basket. That is unquestionably a basket,'” said Tom Rochon.

It is a basket, or rather, a seven-story office building shaped like one-a massive facsimile of the signature picnic basket made by the company once headquartered there. Some 40 miles outside Columbus, Ohio, the basket building, as it’s locally known, is one of the area’s grandest attractions, inviting quirky selfie-seekers, architecture nerds, and, of course, basket enthusiasts.

When the property – slightly larger than another Ohio landmark, Cleveland’s Rock and Roll Hall of Fame-was listed 18 months ago, the asking price was $7.5 million. Now it’s on the market for $5 million, or about $28 a square foot, about half of what traditionally shaped office buildings in the area usually sell for… commercial property in the area typically ranges from $50 to $80 a square foot.

The basket was built for about $32 million and finished in 1997.

My comment: I regularly write about weird properties in my weekly emails, including the Basket House a few years ago. Finally we find out what it is (not) worth. Definitely an Appraisal Challenge!!

———————–

Status Quo Bias: ‘Linear” Thinking in the Real Estate Industry

by Jonathan Miller

Excerpt: When we look at forecasting, planning, trending or anything that includes a look out over the future, I find the real estate industry (i.e. appraisers, real estate agents & brokers) generally thinks along linear lines.

For example:

When housing prices rise…they will rise forever.

When housing prices fall…they will fall forever.

When sales activity rises…they will rise for ever.

When inventory falls…it will fall forever.

When rental prices rise…they will rise forever.

…and so on.

Where does this status quo bias come from?

Click here for some more interesting comments..

http://www.millersamuel.com/status-quo-bias-linear-thinking-in-the-real-estate-industry/

My comment: Of course, I completely agree. It is very important if you work in a market like mine, where residential prices seem to go from stable to increasing and back overnight. I have no idea why. I go on the broker open house tour every week and see what agents are saying. For example, only 1 or 2 offers vs. 5-6 and longer days on market

————————————————-

HOW TO USE THE NUMBERS BELOW. Appraisals are ordered after the loan application. These numbers tell you the future for the next few weeks. For more information on how they are compiled, go to https://www.mba.org

Note: I publish a graph of this data every month in my printed newsletter, Appraisal Today. For more information or get a FREE sample issue go to www.appraisaltoday.com/products or send an email to info@appraisaltoday.com . Or call 800-839-0227, MTW 8AM to noon, Pacific time.

WASHINGTON, D.C. (September 14, 2016

Mortgage applications increased 4.2 percent from one week earlier,

according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 9, 2016. This week’s results included an adjustment for the Labor Day holiday.

The Market Composite Index, a measure of mortgage loan application volume, increased 4.2 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 17 percent compared with the previous week. The Refinance Index increased 2 percent from the previous week. The seasonally adjusted Purchase Index increased 9 percent from one week earlier. The unadjusted Purchase Index decreased 15 percent compared with the previous week and was 8 percent higher than the same week one year ago.

The refinance share of mortgage activity decreased to 62.9 percent of total applications from 64.0 percent the previous week. The adjustable-rate mortgage (ARM) share of activity increased to 4.6 percent of total applications.

The FHA share of total applications increased to 9.6 percent from 9.5 percent the week prior. The VA share of total applications increased to 12.0 percent from 11.9 percent the week prior. The USDA share of total applications increased to 0.7 percent from 0.6 percent the week prior.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) decreased to 3.67 percent from 3.68 percent, with points decreasing to 0.36 from 0.37 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The effective rate decreased from last week.

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $417,000) decreased to 3.64 percent from 3.66 percent, with points increasing to 0.36 from 0.30 (including the origination fee) for 80 percent LTV loans. The effective rate decreased from last week.

The average contract interest rate for 30-year fixed-rate mortgages backed by the FHA decreased to 3.50 percent from 3.52 percent, with points decreasing to 0.27 from 0.35 (including the origination fee) for 80 percent LTV loans. The effective rate decreased from last week.

The average contract interest rate for 15-year fixed-rate mortgages increased to 2.97 percent from 2.96 percent, with points unchanged at 0.34 (including the origination fee) for 80 percent LTV loans. The effective rate increased from last week.

The average contract interest rate for 5/1 ARMs remained unchanged at 2.87 percent, with points increasing to 0.37 from 0.30 (including the origination fee) for 80 percent LTV loans. The effective rate increased from last week.

The survey covers over 75 percent of all U.S. retail residential mortgage applications, and has been conducted weekly since 1990. Respondents include mortgage bankers, commercial banks and thrifts. Base period and value for all indexes is March 16, 1990=100.

How many appraisers are increasing their fees?

Poll: In the past year, have your standard fees for a typical non-complex assignment? www.appraisalport.com

My comment: Good news that the majority of responses were for increased fees. But, less than $50 annual increase is low. If you work for AMCs, your fees will drop when business slows down, assuming you are not getting very low fees now. If you don’t ask for higher fees now, or drop AMCs that insist on low fees, you are losing lots of money. I keep increasing my fees by $50 every 3-4 months and am still below other local appraisers’ fees. Remember, there is little or no AMC “loyalty” to appraisers. They will not remember you when business slows down and you really need work.

WHAT DO YOU THINK? POST YOUR COMMENTS AND READ OTHER COMMENTS AT www.appraisaltodayblog.com

—————————

McMansion Hell in Roseville CA

Just for Fun!!

Excerpt: Nothing in this world is a better metaphor for what politicians and marketers like to call “The American Dream” than the Californian tract house. Imagine – you too, could have your own sloppily put together plot of land on a nice street lined with other sloppily put together plots of land.

But you, of course, want your sloppily put together plot of land to be different from the sloppily put together plots of land of your peers. Now, your houses may have been built at the same time with the same plan by the same builder, but damn are you not determined to find a way to stand out from the crowd.

Finally, after the nth hour of HGTV, it dawns on you: the windows.

http://www.mcmansionhell.com/post/149807609446/roseville-ca

My comment: check out other interesting stuff on this web site. I didn’t even know there were any McMansions in Roseville!!

Poll: In the past year, have your standard fees for a typical non-complex assignment?