Newz: Future of AI in Appraisals,

Comps in Today’s Market

August 1, 2025

What’s in This Newsletter (In Order, Scroll Down)

- LIA ad: Code violations and expertise

- The Future of AI in Real Estate Valuations: Understanding Tomorrow’s Appraisal Standards By Leland Trice

- New York City’s Famous ‘Bubble House’ Hits the Market for the First Time in 50 Years With an Asking Price of $5.8 Million

- The problem with comps in today’s housing market By Ryan Lundquist

- Divorce Appraisal: A Guide for Real Estate Appraisers By Kevin Hecht

- For sale signs multiply: Inventory hits 5-year high, price cuts surge What’s happening with markets all over the country?

- Mortgage applications increased 0.8 percent from one week earlier

———————————————————————–

Click here to subscribe to our FREE weekly appraiser email newsletter and get the latest appraisal news

—————————————————————–

The Future of AI in Real Estate Valuations: Understanding Tomorrow’s Appraisal Standards

By Leland Trice

Excerpts: The real estate valuation industry stands at a pivotal moment. After decades of relying on manual processes that are inefficient, error-prone, and costly, we’re witnessing a fundamental shift toward AI and technology enabled solutions that don’t replace human expertise but amplify them.

The future of real estate valuations will likely involve increasing integration of human expertise with artificial intelligence capabilities. This evolution isn’t about replacing professional judgment with automated systems it’s about creating hybrid approaches that leverage the strengths of both human analysis and machine processing.

Opteon’s new AI-powered quality control tool, built in collaboration with technology partner Jaro, illustrates this broader evolution across our industry.

It’s important to clarify a common misconception: AI-powered tools like Intara, don’t replace appraisers or QC functions. Instead, they enable Appraisers to focus on what they do best, expert analysis and decision-making, while automating repetitive, administrative and time-consuming tasks that add little analytical value.

The “magic” of AI is its ability to look holistically at a file. We have moved past the days of checklist data review and can now examine unstructured data and images simultaneously and in conjunction with discrete data points.

A critical factor in successful AI implementation is the flexibility to meet varying requirements. Intara demonstrates this principle by embedding lender-specific criteria into quality control processes, automatically identifying discrepancies, and ensuring consistency before reports reach final review.

To read more, Click Here

My comments: This article sometimes reads as a “marketing promotion”. But, worth reading to see how one company uses AI for appraisals and how it is used.

This article goes way beyond Chat GPT. It shows how custom AI applications can work for appraisals. The author, Leland Trice, is Managing Director at Opteon USA.

New York City’s Famous ‘Bubble House’ Hits the Market for the First Time in 50 Years With an Asking Price of $5.8 Million

Excerpts: 4 bedrooms, 5 baths, 4,763 sq.t. Townhouse

The distinctive bubbly residence has become a somewhat divisive hot spot in its Lenox Hill neighborhood, where it was built in 1969, with architect Maurice Medcalfe transforming a traditional brownstone into the eye-popping modernist masterpiece.

Medcalfe’s unique window design was intended to be “a sculptural interpretation of the classic bay window,” according to reports.

There is plenty to play with in the four-story interior, which boasts 4,736 square feet of space and includes four bedrooms, an office, and five bathrooms that are “all in need of renovation,” according to the listing.

To read the listing with 13 photos Click Here

—————————————————————————————-

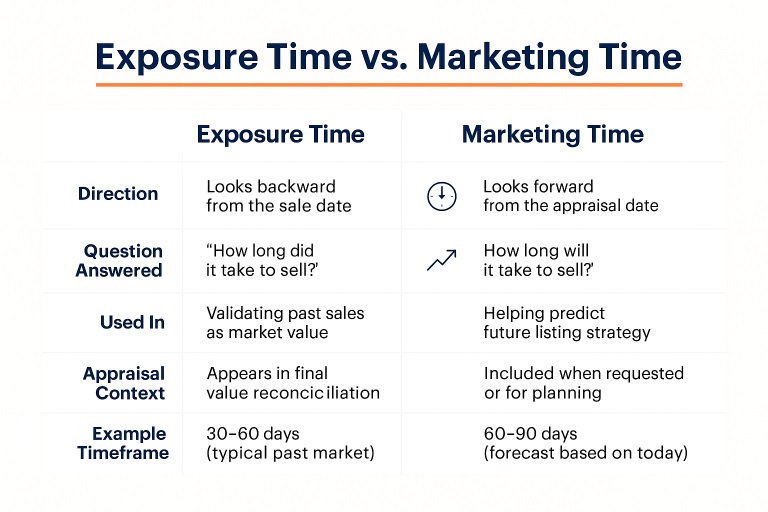

The problem with comps in today’s housing market

By Ryan Lundquist

July 24, 2025

Excerpts: We have a problem with comps in today’s real estate market. Well, technically the comps aren’t the issue. We’re just not always looking at them in the right way.

1) FOCUS ON THE CONTRACT DATE: Definitely give weight to sales because they actually closed, but ask yourself how much the market has changed since those properties got into contract. Remember, the price was basically established at the contract date (and some negotiation while in contract), so we’re going to focus on the contract date more than the closed date when trying to figure out how different the market is from the time the price was established. In a softening market, if you use a sale from the spring, don’t be afraid to give a negative adjustment to the property to bring it down to what buyers are willing to pay today.

2) LOOK FOR A PATTERN: Don’t hang your perception of value on just one property. We want to look for a group of sales, pendings, and listings. In other words, we don’t want to view one lower pending and base our entire perception of value on that property. That’s not enough data to show a trend. What if that one pending was priced low to generate interest? Or what if it smelled like 20 cats? This is why we want to look for a pattern instead of just one example. It would be like me going to the mall and seeing a teenager sporting a sweet mullet. Does that mean mullets are back in style? Or is it an isolated incident? Seeing one bro with “business in front and a party in the back” isn’t enough to say it’s a trend.

3) GO OLDER & WIDER: There aren’t many sales today, so we may have to look at what’s going on in competitive neighborhoods to wrap our minds around value. We might also have to look at much older sales in the immediate neighborhood to understand how prices have moved…

To read more, Click Here

My comments: Housing markets are hard to figure out in many parts of the country today.

—————————————————————————————-

Are you getting too many ad-only emails?

4 ways to get only the FREE email newsletters and NOT the ad-only emails.

1. Twitter: https://twitter.com/appraisaltoday Posted by noon Friday

2. Read on blog www.appraisaltoday.com/blog Posted by noon Friday. You can subscribe to the blog in the upper right of each blog page. NOTE: the popular ads with liability tips are below the first topic on my blog posts.

3. Email Archives: https://appraisaltoday.com/archives

(posted by noon Friday) The link is above and to the left of the big yellow email signup form. Newsletters start with “Newz.” Contains all recent emails sent.

4. Link to the 10 most recent newsletters (no ads) at www.appraisaltoday.com. Scroll down past the big yellow signup block. The newsletters have abbreviated titles, taken from their blog posts.

To read more about the 4 ways, plus information on why I take ads, etc.

Click here

———————————————————————

Annual E&O issue

In the August 2025 issue of Appraisal Today

- Loose Lips Cause Claims (Loose Lips Lead to Lawsuits) by Clauda Gaglione, Esq.

- 2025 E&O Insurance Update – Claims, Payment Options, Lawsuits, etc., By Clauda Gaglione, Esq and Magda Pretorius, Risk and Claims Analyst with LIA

- 2025 E&O Insurance Update – Where to Get E&O Insurance, What to Look for

- 2025 E&O Insurance Brokers

————————————————————————————-

Loose Lips – with 3 very good case studies on confidentiality.

Update – Discrimination claims, What if you can’t afford E&O now, Licensing board complaints and good legal advice.

E and O insurance – where to get it, list of brokers, get tail coverage if you’re retiring or quitting, check policy exclusions carefully and more.

Brokers – 7 brokers who have been doing appraiser E&O for a while.

—————————————————————————————

To read the full article, plus 3+ years of previous issues, subscribe to the paid Appraisal Today at www.appraisaltoday.com/order .

Not sure if you want to subscribe?

Sign up for monthly auto renewal for $8.25!

Cancel at any time for any reason! You will receive a prorated refund.

$8.25 per month, $24.75 per quarter, and $89 per year (Best Buy)

or $99 per year or $169 for two years

Subscribers get FREE: past 18+ months of past newsletters

What’s the difference between the Appraisal Today free Weekly email newsletter and the paid Monthly newsletter? Click here for more info.Subscribe to Monthly NewsletterIf you are a paid subscriber and did not receive the August 2025 issue emailed on Friday, August 1 2025 please email info@appraisaltoday.com, and we will send it to you. You can also hit the reply button. Be sure to include a comment requesting it.

———————————————————————————–

Divorce Appraisal: A Guide for Real Estate Appraisers

By Kevin Hecht

Excerpts: If you’re a real estate appraiser who typically handles mortgage-based appraisals, consider branching out into the realm of divorce appraisals (otherwise known as an appraisal for marital dissolution). This specialized niche can help you diversify your business while offering a service that’s always in demand.

Divorce appraisals come with their own unique considerations, challenges, and opportunities. Here’s what you need to know.

How Divorce Appraisals Differ from Traditional Mortgage-Based Appraisals

Divorce appraisals are different from mortgage appraisals in terms of the reporting flexibility and scope of work determination.

While mortgage appraisals require specific forms, such as the Uniform Residential Appraisal Report (URAR), divorce appraisals are not bound by these standardized forms. You might choose to use a narrative report, a verbal report, or another format depending on the needs of the assignment (However, please remember that the GSE forms are not appropriate for these types of assignments.).

Common challenges include:

- Tight court-imposed deadlines

- Emotional sensitivity

- Difficulty gaining property access

- Disputes over property improvements

- Heightened scrutiny of the appraisal

- To address these challenges, you’ll need to prioritize communication, documentation, and customer service—three best practices that are more important than ever in a divorce appraisal assignment.

To read more, Click Here

My comments: Few residential appraisers do divorce appraisals. Appraisal and expert witness fees are much higher than lender appraisals.

I have done divorce appraisals and have written about doing them in my monthly Appraisal Today newsletter.

I always assume court testimony will be required, even if the attorney says not. You will need to learn about expert witness requirements. This is why residential appraisers are reluctant to do divorce appraisals. Little competition, of course.

What is great about divorce appraisals: No AMCs, No UAD 3.6, seldom have reviews and much more. I gave up residential lender appraising in 2005.

Death, Divorce and Taxes. Great opportunities For Appraisers!

—————————————————————————————-

For sale signs multiply: Inventory hits 5-year high, price cuts surge What’s happening with markets all over the country?

Buyers gain negotiating leverage in newly balanced housing market

- 1.36 million homes were for sale in June, the most since November 2019.

- The market is balanced or in buyers’ favor in 28 of the 50 largest US metros.

- A record-high 26.6% of listings dropped prices in June; cuts are most common in the Sun Belt and Mountain West.

To read more, Click Here

My comments: This is happening all over the country. Why is it happening? Below is my opinion.

Many people, including myself, have great uncertainty about the effects of tariffs on our economy. I am financially risk averse and have always had my retirement savings in a money market fund. I have no stocks or bonds. I would never buy a home now. I am advising buyers who are risk averse to “wait and see”. If risk averse, sellers should reduce their prices and sell their homes now.

Sellers want to sell for high prices. If not risk averse, today may be a good time to lower their listing price. For some buyers, it is a good time as there are few buyers as competition is lower.

Investors reportedly are buying homes. They are much less risk averse.

—————————————————————————————-

HOW TO USE THE NUMBERS BELOW. Appraisals are ordered after the loan application. These numbers tell you the future for the next few weeks. For more information on how they are compiled, Click Here.

Note: I publish a graph of this data every month in my paid monthly newsletter, Appraisal Today. For more information or get a FREE sample go to www.appraisaltoday.com/order Or call 510-865-8041, MTW, 7 AM to noon, Pacific time.

My comments: Rates are going up and down. We are all waiting for rates to drop in 2025.

Mortgage applications increased 0.8 percent from one week earlier

Mortgage applications increased 0.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 18, 2025.

The Market Composite Index, a measure of mortgage loan application volume, increased 0.8 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 1 percent compared with the previous week. The Refinance Index decreased 3 percent from the previous week and was 22 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 3 percent from one week earlier. The unadjusted Purchase Index increased 4 percent compared with the previous week and was 22 percent higher than the same week one year ago.

“The 30-year fixed mortgage rate edged higher last week to its highest level in four weeks at 6.84 percent, while rates for other loan types were mixed. Purchase applications finished the week higher, driven by conventional purchase loans, and continue to run ahead of last year’s pace,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “After reaching $460,000 in March 2025, the purchase loan amount has fallen to its lowest level since January 2025 to $426,700. With the 30-year fixed rate still too high to benefit many borrowers, refinance applications were down almost three percent for the week.”

The refinance share of mortgage activity decreased to 39.6 percent of total applications from 41.1 percent the previous week. The adjustable-rate mortgage (ARM) share of activity increased to 7.2 percent of total applications.

The FHA share of total applications decreased to 18.7 percent from 19.0 percent the week prior. The VA share of total applications remained unchanged at 12.6 percent from the week prior. The USDA share of total applications increased to 0.6 percent from 0.5 percent the week prior.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($806,500 or less) increased to 6.84 percent from 6.82 percent, with points remaining unchanged at 0.62 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The effective rate increased from last week.

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $806,500) remained unchanged at 6.75 percent, with points increasing to 0.70 from 0.66 (including the origination fee) for 80 percent LTV loans. The effective rate increased from last week.

The average contract interest rate for 30-year fixed-rate mortgages backed by the FHA remained unchanged at 6.52 percent, with points decreasing to 0.79 from 0.86 (including the origination fee) for 80 percent LTV loans. The effective rate decreased from last week.

The average contract interest rate for 15-year fixed-rate mortgages decreased to 6.14 percent from 6.16 percent, with points increasing to 0.69 from 0.63 (including the origination fee) for 80 percent LTV loans. The effective rate remained unchanged from last week.

The average contract interest rate for 5/1 ARMs decreased to 6.01 percent from 6.08 percent, with points decreasing to 0.28 from 0.45 (including the origination fee) for 80 percent LTV loans. The effective rate decreased from last week.

The survey covers U.S. closed-end residential mortgage applications originated through retail and consumer direct channels. The survey has been conducted weekly since 1990. Respondents include mortgage bankers, commercial banks, thrifts, and credit unions. Base period and value for all indexes is March 16, 1990=100.

Ann O’Rourke, MAI, SRA, MBA

Ann O’Rourke, MAI, SRA, MBA

Appraiser and Publisher Appraisal Today

1826 Clement Ave. Suite 203 Alameda, CA 94501

Phone: 510-865-8041

Email: ann@appraisaltoday.com

Online: www.appraisaltoday.com

Posted in:

AI,

appraisal how to,

liability,

non lender appraisals,

real estate market

Ann O’Rourke, MAI, SRA, MBA

Ann O’Rourke, MAI, SRA, MBA