Newz: ADU vs. Two-Family Property,

Everyone Must Be Ready for UAD 3.6

November 21, 2025

What’s in This Newsletter (In Order, Scroll Down)

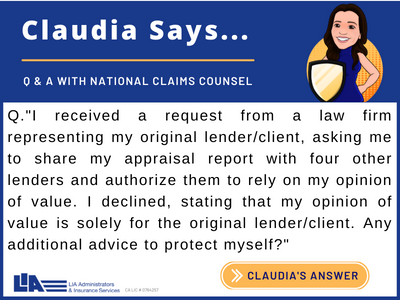

- LIA: Protecting My Appraisal Report

- How to Identify a Single-Family with ADU vs. Two-Family Property

- $1 Million Midcentury Modern Ranch House on Lake Michigan Holds a Wild Surprise in the Basement

- Top Appraisers Advise on How to Generate New Business

- When One Bulb Fails… Why Everyone Must Be Ready for UAD 3.6 By Tony Pistilli

- A Real Estate Agent’s Guide to Understanding the New UAD 3.6 Appraisal Report By Tom Horn

- MBA: Mortgage applications decreased 5.2 percent from one week earlier

———————————————————————-

Click here to subscribe to our FREE weekly appraiser email newsletter and get the latest appraisal news

————————————————————–

How to Identify a Single-Family with ADU vs. Two-Family Property

Excerpts: Across the country, accessory dwelling units (ADUs) are becoming more common. Cities and counties are updating zoning laws to encourage them, whether to increase housing supply, create affordable rental options, or allow families to live closer together. Appraisers need to understand how ADUs fit into their local markets, how they’re used and perceived, and how to properly distinguish them from true two-family properties.

The presence of an additional living unit can complicate the appraisal process by making it difficult for you, the appraiser, to know how to classify the subject property. How do you know whether you’re dealing with an accessory dwelling unit (ADU) or a second unit? In this article, you’ll learn about ADU meaning and types as well as how to identify a single-family with ADU vs. two-family property.

Topics include:

- What Is an ADU?

- Do ADUs Add Value to a Property?

- Types of ADUs

- What Is a Two-Family Property?

- Is It a Single-Family with an ADU or Two-Family Property?

To read more and watch an ADU video, Click Here

My comments: Good explanations of ADU issues. Well done short video. UAD 3.6 requires including details on ADUs.

——————————————————————

$1 Million Midcentury Modern Ranch House on Lake Michigan Holds a Wild Surprise in the Basement

Excerpts: 3 bedrooms, 2 baths, 2,568 sq.ft., 3.1 acre lot, built in 1959

Upon first glance, the three-bedroom home looks much like a traditional single-story bungalow, complete with a charming brick façade, covered porch, and red-framed windows.

But at the back of the Caledonia, WI, home, a very different reality presents itself: The dwelling actually dips down over the side of a hill, concealing a spacious lower level.

And what lies beneath in that basement story certainly has to be seen to be believed: an expansive private theater complete with tiered seating, professional lights, and a historical organ that takes center stage in the artistic space.

The lavish, one-of-a-kind music auditorium features chandeliers, a projection booth, and seating for 50. The furnishings were collected from nearly 50 different theaters across the country that were being demolished.

The focal point of the theater is the biggest Wurlitzer pipe organ ever built, which boasts five keyboards and four organ chambers.

The property “also sits on 3 acres with frontage along Lake Michigan,” Cape says.

To read more, Click Here

To read the listing and see an aerial view plus more photos, Click Here

My comment: Added value of a “basement” theater ???

—————————————————–

Top Appraisers Advise on How to Generate New Business

Excerpts: What are some ways appraisers can generate new business and new leads, outside of AMCs? How do the top appraisers market themselves? We interviewed three leaders in the appraisal profession to find out. Plus, we surveyed our larger appraisal community for additional tips and insights.

Keep reading to learn the most effective marketing strategies according to experts and seasoned appraisers, as well as techniques to get your name out there and make yourself more marketable.

Topics include:

- Add Some Non-Lender Work into the Mix

- Put Out a Monthly Newsletter

- Build New Relationships

- Leverage Online Marketing Tools

- Diversify Your Client List

Survey results: Top three ways to generate new appraisal business,

- Build new relationships

- Diversify your client list

- Leverage online marketing tools

To read more, Click Here

My comments: Many appraiser comments. Worth reading for new ideas or just to see what appraisers say. The survey results are interesting also. I have written many articles about appraiser marketing and non-lender appraisals in my monthly newsletter, starting in 1993.

I dropped all lender residential appraisals in 2005. The URAR was updated with codes in the sales comparison grid. I never updated my software so I would not be tempted to do them. I had been accepting non-lender appraisals since I started my business in 1986.

———————————————————–

Are you getting too many ad-only emails?

4 ways to get only the FREE email newsletters and NOT the ad-only emails.

1. Twitter: https://twitter.com/appraisaltoday Posted by noon Friday

2. Read on blog www.appraisaltoday.com/blog Posted by noon Friday. You can subscribe to the blog in the upper right of each blog page. NOTE: the popular ads with liability tips are below the first topic on my blog posts.

3. Email Archives: https://appraisaltoday.com/archives

(posted by noon Friday) The link is above and to the left of the big yellow email signup form. Newsletters start with “Newz.” Contains all recent emails sent.

4. Link to the 10 most recent newsletters (no ads) at www.appraisaltoday.com. Scroll down past the big yellow signup block. The newsletters have abbreviated titles, taken from their blog posts.

To read more about the 4 ways, plus information on why I take ads, etc.

==================================

Appraisal Today articles on UAD 3.6

——————————————

April 2025 – first article

New URAR What It Means for Appraisers

Fannie Q and As and other information available in April.

————————————-

May 2025

Review of Appraiser’s Guide to the New URAR Class

How to use Document F-1 to find what GSEs want in the PDF Report plus other introductory information and a review of the class.

————————-

June 2025: What is new in the New URAR

Introduction to UAD 3.6 and more info on topics in May 2025 and Scenario SR 1 – Single Family, used in many demos and discussions. I go through every page of the 20 page document and include what is new with references document F-1

Additional PDFs (on Paid subscriber web page):

Sample Scenario SF1 (Single Family) PDF Report – discussed in this article

Appendix F-1 URAR Reference Guide v1.2 14 MB

Fannie Sample Scenario PDFs Combined 15MB All scenarios

————————————————–

July 2025: From UAD 2.6 to UAD 3.6.

What appraisal software vendors are doing.

First article on this topic. I had live demos on Bradford, alamode, and SFREP. I asked them specific questions about fields. None of the vendors were “ready to go” on their software. 5 screen shots are included at the end of the article.

———————————————-

November, 2025: UAD 3.6 Update – Software Vendors, Both Old and New and More Info

In October, none of the software vendors were ready to use software for completing appraisals. All are focusing on the Broad Production start date of January 26, 2026, but I don’t know who will complete the software by that date.

Recently appraiser Andy Arledge developed UAD 3.6 software. He

previously developed Appraiser Genie Software (Genie Cloud does adjustment support, Cost Approach and more) He now has Freedom Appraise software for UAD 3.6, similar to the other companies above.

Coming in the December Issue

UAD 3.6 Update – what software vendors are doing now. None are completely ready to go with a GSE approved report software, inspection app (critical) , AI, and “add ons” such as sketch software and other software such as DataMaster and Spark.

To read the full article, plus 4 more UAD 3.6 articles, plus 2+ years of previous issues, subscribe to the paid Appraisal Today at www.appraisaltoday.com/order .

Not sure if you want to subscribe?

Sign up for monthly auto renewal for $8.25!

Cancel at any time for any reason! You will receive a prorated refund.

$8.25 per month, $24.75 per quarter, and $89 per year (Best Buy)

or $99 per year or $169 for two years

Subscribers get FREE: past 18+ months of past newsletters

What’s the difference between the Appraisal Today free Weekly email newsletter and the paid Monthly newsletter? Click here for more info.Subscribe to Monthly Newsletter

———————————————————–

If you are a paid subscriber and did not receive the

November, 2025 issue emailed on

Monday, November 3 , 2025 please email info@appraisaltoday.com, and we will send it to you. You can also hit the reply button. Be sure to include a comment requesting it. Or, call 510-865-8041

———————————————————

When One Bulb Fails… Why Everyone Must Be Ready for UAD 3.6

By Tony Pistilli

Excerpts: Imagine standing before a beautifully decorated Christmas tree, ready to flip the switch. You plug in the lights and nothing happens. You check the plug, the length of the wire and each bulb, one at a time, until you find that one tiny bulb somewhere along the strand is broken or loose, and its causing the entire string of lights from working.

Similarly, in complex systems, the weakest link often determines how well the system functions or whether the system functions at all. The upcoming mandate for the Uniform Appraisal Dataset 3.6 (UAD 3.6) and the redesigned Uniform Residential Appraisal Report (URAR) is such a system. If any single stakeholder in the mortgage/valuation chain fails to support the standard, the entire “string” of appraisal-to-loan delivery can go dark.

That’s why appraisal software, appraisers, appraisal management companies, lenders and even the GSEs, must all be certified and/or ready to go for UAD 3.6 to work as intended.

The intent behind UAD 3.6 is sound. The GSEs envision a future where every appraisal report flows through a standardized data structure, allowing automated checks for completeness, consistency, and reasonableness. This improves quality control, speeds up underwriting, and reduces repurchase risk. All good things for everyone involved.

For lenders, this hopefully means fewer delays and cleaner first time submissions. For AMCs and appraisal technology providers, it promises streamlined operations and transparency. And for appraisers, it’s an opportunity to be recognized not just as form fillers or report writers but as data professionals in an evolving digital mortgage process.

But this transformation requires total synchronization. UAD 3.6 isn’t simply a new “form.” It’s like an entirely new language and every participant must speak it fluently, from the moment an appraisal order is created to the moment the report is submitted to the GSE portal.

That undeniable interdependence is precisely why partial readiness won’t work. The system only functions when every “bulb” is working in unison.

Appraisers at the Center

Every modernization effort in mortgage lending eventually comes down to people. And appraisers sit at the center of this one – again.

Even if every system upstream and downstream is certified or ready for UAD 3.6, the entire process begins with the professional boots on the ground inspecting the property and completing the report. If appraisers aren’t trained, equipped, or willing to adopt the new framework, no amount of readiness elsewhere will matter.

To read more, Click Here

My comments: Definitely worth reading. The author has over 30 years of executive-level real estate valuation and lending experience including working with national banks, mortgage companies, federal agencies, and leading appraisal management firms. He is a certified residential real estate appraiser in Texas and is an AQB Certified USPAP Instructor.

Since May 2025 I have been writing about UAD 3.6, more recently focusing on the software vendors. Only one new vendor (Aivre) plus SFREP have GSE “approved” report software (per Fannie website) Aivre still working on their mobile app, AI features, etc.

Appraisers cannot learn how to do the new UAD 3.6 reports if the software is not available.

———————————————————–

A Real Estate Agent’s Guide to Understanding the New UAD 3.6 Appraisal Report

By Tom Horn

Excerpts: This update doesn’t just affect appraisers. It also changes how agents, buyers, and sellers read and understand the report.

I recently spoke with an office of real estate agents discussing the new UAD 3.6 and how it affects them. I thought I would create this post to help educate other agents who are interested in learning more about this new report format.

How It Helps Agents

For agents, the biggest benefit of the UAD 3.6 appraisal report is clarity.

It’s easier to see how the appraiser arrived at the opinion of value without getting lost in technical terms.

Here’s what that means for agents:

- Easier conversations with buyers and sellers about how value was determined.

- Fewer misunderstandings when the appraised value is higher or lower than expected.

- A clearer picture of how updates and repairs were considered.

4. How It Helps Agents

For agents, the biggest benefit of the UAD 3.6 appraisal report is clarity.

It’s easier to see how the appraiser arrived at the opinion of value without getting lost in technical terms.

6. Here’s what that means for agents:

- Easier conversations with buyers and sellers about how value was determined.

- Fewer misunderstandings when the appraised value is higher or lower than expected.

- A clearer picture of how updates and repairs were considered.

To read more, Click Here

My comments: A local appraiser I know gave a presentation on this topic recently. He included copies of a sample report (SR1) and used Fannie slides for illustration. He compared the current form reports to the UAD 3.6 reports. They liked the new reports much better than the old forms.

You can try doing a presentation yourself to real estate agents. Most Excellent Marketing opportunity for you. This will also help you explain the new reports to real estate agents.

————————————————————-

HOW TO USE THE NUMBERS BELOW. Appraisals are ordered after the loan application. These numbers tell you the future for the next few weeks. For more information on how they are compiled, Click Here.

Note: I publish a graph of this data every month in my paid monthly newsletter, Appraisal Today. For more information or get a FREE sample go to www.appraisaltoday.com/order Or call 510-865-8041, MTW, 7 AM to noon, Pacific time.

My comments: Rates are going up and down. We are all waiting for rates to drop lower in 2025.

Mortgage applications decreased 5.2 percent from one week earlier

WASHINGTON, D.C. (November 19, 2025) — Mortgage applications decreased 5.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 14, 2025.

The Market Composite Index, a measure of mortgage loan application volume, decreased 5.2 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 7 percent compared with the previous week. The Refinance Index decreased 7 percent from the previous week and was 125 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index decreased 7 percent compared with the previous week and was 26 percent higher than the same week one year ago.

“Mortgage rates increased for the third consecutive week, with the 30-year fixed rate inching higher to its highest level in four weeks at 6.37 percent,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Application activity over the week was lower, with potential homebuyers moving to the sidelines again, although there was a small increase in FHA purchase applications. Refinance applications decreased as borrowers remain sensitive to even small increases in rates at this level. The overall average loan size across both purchase and refinance applications dipped to its lowest level since August of this year, driven by another drop in the ARM share.”

The refinance share of mortgage activity decreased to 55.4 percent of total applications from 55.6 percent the previous week. The adjustable-rate mortgage (ARM) share of activity decreased to 7.5 percent of total applications.

The FHA share of total applications increased to 19.9 percent from 19.4 percent the week prior. The VA share of total applications increased to 15.2 percent from 14.8 percent the week prior. The USDA share of total applications increased to 0.3 percent from 0.2 percent the week prior.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($806,500 or less) increased to 6.37 percent from 6.34 percent, with points remaining unchanged at 0.62 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The effective rate increased from last week.

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $806,500) decreased to 6.39 percent from 6.46 percent, with points increasing to 0.42 from 0.38 (including the origination fee) for 80 percent LTV loans. The effective rate decreased from last week.

The average contract interest rate for 30-year fixed-rate mortgages backed by the FHA remained unchanged at 6.14 percent, with points increasing to 0.84 from 0.76 (including the origination fee) for 80 percent LTV loans. The effective rate increased from last week.

The average contract interest rate for 15-year fixed-rate mortgages increased to 5.83 percent from 5.70 percent, with points increasing to 0.69 from 0.64 (including the origination fee) for 80 percent LTV loans. The effective rate increased from last week.

The average contract interest rate for 5/1 ARMs increased to 5.65 percent from 5.50 percent, with points decreasing to 0.81 from 0.85 (including the origination fee) for 80 percent LTV loans. The effective rate increased from last week.

The survey covers U.S. closed-end residential mortgage applications originated through retail and consumer direct channels. The survey has been conducted weekly since 1990. Respondents include mortgage bankers, commercial banks, thrifts, and credit unions. Base period and value for all indexes is March 16, 1990=100.

Mortgage Bankers Association

1919 M Street NW

5th Floor

Washington, DC 20036

(202) 557-2700

(800) 793-622

———————————————–

Ann O’Rourke, MAI, SRA, MBA

Ann O’Rourke, MAI, SRA, MBA

Appraiser and Publisher Appraisal Today

1826 Clement Ave. Suite 203 Alameda, CA 94501

Phone: 510-865-8041

Email: ann@appraisaltoday.com

Online: www.appraisaltoday.com