Newz: Paired Sales Analysis, AI and Appraisers?

February 27, 2026

What’s in This Newsletter (In Order, Scroll Down)

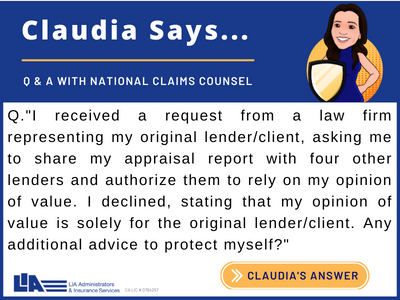

- LIA AD: When Confidentiality Agreements Conflict with USPAP

- Paired Sales Analysis: Tips and Tools for Appraisers

- Converted Church With Bell Tower and Pulpit Lists for $225K

- Determining Assignment Conditions in a Vacuum By Jo Ann Aposto

- MY AD: An Appraiser Gets Audited by the IRS! My Story Don’t Make My Mistakes! By Ann O’Rourke

- Artificial Intelligence: Friend or Foe of Appraisers?

- Fed moves to pull mortgages back into banking fold

- MBA: Mortgage applications increased 0.4 percent from one week earlier

———————————————————————————

Click here to subscribe to our FREE weekly appraiser email newsletter and get the latest appraisal news

Paired Sales Analysis: Tips and Tools for Appraisers

By Kevin Hecht

Excerpts: Though not without challenges, paired sales analysis is a valuable technique to have in your appraisal toolkit. Mastering this method will help you develop more accurate, credible, and defensible appraisals.

This guide presents a step-by-step approach to performing paired sales analysis, practical tips and tools to improve your accuracy, plus strategies to overcome common challenges like sparse comparable data.

Paired Sales Analysis Example

For example, suppose two very similar homes in the same neighborhood sell within three months of each other. One house has a separate two-car garage, while the other does not. If the garage-equipped home sold for $15,000 more, you can reasonably infer that the garage adds $15,000 in value.

Uses

Primarily used in the sales comparison approach, paired sales analysis is particularly useful for estimating the value of unique property attributes such as:

- Location advantages (corner lots, cul-de-sac positions, or waterfront access)

- Scenic views or privacy features

- Property upgrades (pools, finished basements, luxury kitchens)

- Additional structures (workshops, guest houses, storage buildings)

- Land size variations or irregular lot configurations

- What is paired sales analysis

- Step-by-Step Methodology of a Paired Sales Analysis…

- Paired Sales Analysis Tips and Best Practices

- Additional Tips Shared by Appraisers

- Overcoming Challenges: What to Do When Data Is Sparse

To read more, Click Here

My comments: Comprehensive and definitely worth reading. I have regularly used paired sales, when I could find good comps. I often go back in time, as market conditions adjustments are easy to do. I got a few new ideas I had not thought of before in this article.

—————————————————————-

Converted Church With Bell Tower and Pulpit Lists for $225K

Excerpts: 2 bedroom, 2 bath, 2,028 sq.ft., 1.2 acre lot, built in 1906

Former church currently used as a recording studio. Current owner has made many upgrades including: addition of 2 non-conforming bedrooms and a laundry room in the lower level, new HVAC in 2023, pellet stove for additional heat, radon mitigation system in 2022, shower added to main level bath, stairs and bell tower remodeled, Upflush Sanipro toilet system in lower level bath, Smart Lights (GE Sync App), new washer and dryer, lots of plumbing and electrical upgrades, new roof on the bell tower, new lower level deck, gravel parking, a shed, and much more!

To see the listing with aerial view, video tour and 23 photos, Click Here

My comments: When I accepted my first religious facility appraisal, I contacted a local appraiser who was an expert on appraising these properties. I learned a lot about how hard it could be getting approvals for new construction (traffic issues mostly), too many of them in some areas where they were being sold for other uses, and more issues. Highest and best use could be tricky for larger religious facilities with declining membership.

There are many more small religious facilities on the East Coast than on the West Coast, where I live.

————————————————————-

Determining Assignment Conditions in a Vacuum

By JoAnn Apostol

Excerpts: I spend some time on social media in appraisal groups reading and commenting on different posts. I often read where the poster is asking if they should call a condition out or require an inspection by a professional on an assignment. Let’s say there is a safety issue noted during the site visit, and the poster is asking the masses how to handle it. Often, these are on FHA assignments, but I also see them on conventional assignments.

It still amazes me that so many ask these questions in appraisal forums just due to the wide variety of responses that are given.

The issue is that often, the poster will just move forward with making the appraisal subject to an inspection or a repair. For FHA, often those are based on the handbook which requires safety, soundness and security. In conventional financing, however, not all assignments should be completed using guidelines of Fannie or Freddie.

Federal lending guidelines require the appraisal to be “as-is.” Not all lenders, clients or intended uses want a value that is “subject-to” something. Based on the problem identification in USPAP, use of “subject-to” should be communicated to the client to ensure the scope of work is appropriate for the intended use.

To read more, Click Here

My comments: Read this article to keep from facing your state board. I regularly hear from appraisers who are using “subject to” when the client is not selling the appraisal to the GSEs. I do mostly estate work, which is “as is” on the date of death. Now I understand what to tell the appraisers. Or, give them a link to this article!Are you getting too many ad-only emails?

4 ways to get only the FREE email newsletters and NOT the ad-only emails.

1. Twitter: https://twitter.com/appraisaltoday Posted by noon Friday

2. Read on blog www.appraisaltoday.com/blog Posted by noon Friday. You can subscribe to the blog in the upper right of each blog page. NOTE: the popular ads with liability tips are below the first topic on my blog posts.

3. Email Archives: https://appraisaltoday.com/archives

(posted by noon Friday) The link is above and to the left of the big yellow email signup form. Newsletters start with “Newz.” Contains all recent emails sent.

4. Link to the 10 most recent newsletters (no ads) at www.appraisaltoday.com. Scroll down past the big yellow signup block. The newsletters have abbreviated titles, taken from their blog posts.

To read more about the 4 ways, plus information on why I take ads, etc.

Click hereAn Appraiser Gets Audited by the IRS! My Story

———————————————–

Don’t Make My Mistakes! By Ann O’Rourke

In the March 2025 issue of Appraisal Today

Excerpts: What were my mistakes?

I did not have receipts for all expenses. Now I keep printed copies of all

receipts.

I did not have a mileage log. Not unusual for appraisers. I “guesstimated” my

mileage as a percent of total mileage.

How much time we spent getting ready for the audit

My bookkeeper and I spent many weeks preparing, almost full time. We had

to get bank statements that were no longer available online, set up a mileage log, meetings with my enrolled agent and more.

The IRS agent inspected my home office and we had to get it cleaned up. We passed the inspection.

IRS’ top audit priority – unreported income – my biggest mistake

I use Quickbooks for bookkeeping. We had made an error in reporting

income as an expense. We did not have Quickbooks set up properly. There was an $11,000 difference. Overall, including the time of my enrolled agent, the audit cost me about $18,000, including payments to my enrolled agent, penalties and interest.

To read the full article, plus 2+ years of previous issues, subscribe to the paid Appraisal Today at www.appraisaltoday.com/order

Not sure if you want to subscribe?

Sign up for monthly auto renewal for $8.25!

Cancel at any time for any reason! You will receive a prorated refund.

$8.25 per month, $24.75 per quarter, and $89 per year (Best Buy)

or $99 per year or $169 for two years

Subscribers get FREE: past 18+ months of past newsletters

What’s the difference between the Appraisal Today free Weekly email newsletter and the paid Monthly newsletter? Click here for more info.

————————————————————-

If you are a paid subscriber and did not receive the

February, 2026 issue emailed on

Monday February 2, 2026 please email info@appraisaltoday.com, and we will send it to you. You can also hit the reply button. Be sure to include a comment requesting it. Or, call 510-865-8041

Artificial Intelligence: Friend or Foe of Appraisers?

by Isaac Peck, Publisher WorkingRe

Excerpts: Within the valuation community, AI has been discussed, debated, and sometimes feared for years. For some, it represents efficiency and opportunity. For others, it raises familiar concerns about automation, job displacement, and the erosion of professional judgment. The idea that “robots will replace appraisers” has become a recurring refrain even as appraiser licensing was just getting passed in the 1990s.

But setting aside the sky-is-falling rhetoric and the fearmongering, a more grounded question remains: what does the rise of AI actually mean for working appraisers?

How will AI change appraisal software? How will it alter workflow, analysis, and reporting? Where does it genuinely save time and where does it introduce new risks?

And from a more practical standpoint, can appraisers use AI today to run stronger businesses, work more efficiently, and increase profitability without sacrificing judgment, credibility, or compliance?

This article looks past the hype to examine how AI is already showing up in appraisal work, where it offers real value, where caution is essential, and what appraisers need to understand as the technology continues to evolve in 2026 and beyond.

Appraisers interviewed who are using AI: Dustin Harris and Roy Meyer. Both have been using AI for awhile in their appraisals and appraisal businesses. I took a ChatGPT webinar from Roy Meyer which was practical and understandable.

From Software Efficiencies to Guardrails

While individual appraisers may experiment with AI in marketing, communication, and workflow, the way appraisal report software adapts to AI carries far greater implications. Reporting software sits at the center of valuation credibility, compliance, and risk.

To understand how that core function may evolve and where automation still has limits, Working RE spoke with leaders at two of the largest appraisal report software providers, Bradford Technologies and a la mode (a division of Cotality). Their perspectives highlight where automation can genuinely help appraisers, and where guardrails remain critical.

To read more, Click Here

My comments: Worth reading understandable and covers all the topics. Long article but well written and not too technical. He interviews appraisers who have been doing AI for a while. He also interviews Matt Krodel real estate tech guru and principal project manager at a la mode/Cotality | a la mode for a software point of view. AI liability is explained by Brianna Walker, Senior Underwriter at OREP Insurance.

————————————————–

Fed moves to pull mortgages back into banking fold

Bowman outlines plan to address ‘significant migration’ of mortgage origination away from the banking channel

Excerpts: Federal Reserve vice chair for supervision Michelle Bowman used a speech to community bankers in Orlando to signal that the central bank is prepared to rethink how capital rules treat mortgage lending – and, in the process, try to pull a shrinking share of US home loans back onto bank balance sheets.

Bowman said the data showed “a significant migration of mortgage origination and servicing out of the banking sector” since the financial crisis. In 2008, banks originated around 60% of mortgages and held the servicing rights on about 95% of mortgage balances; by 2023 those shares fell to 35% and 45% respectively, she said.

Nonbank dominance and stability concerns

A 2024 Financial Stability Oversight Council report found that nonbank mortgage companies originated roughly two‑thirds of US mortgages in 2022 and owned more than half of servicing rights, while highlighting vulnerabilities around liquidity, funding and resolution planning.

Regulators including the FDIC have warned that nonbank servicers now manage a majority of US mortgages and often rely on short‑term wholesale funding, with MSRs that can be volatile and highly dependent on models and subjective judgement.

To read more, Click Here

My comments: I have been worried for a long time about the financial risks of mortgages from non-banks. Compared with banks, they have much less regulation.

———————————————————–

HOW TO USE THE NUMBERS BELOW. Appraisals are ordered after the loan application. These numbers tell you the future for the next few weeks. For more information on how they are compiled, Click Here.

Note: I publish a graph of this data every month in my paid monthly newsletter, Appraisal Today. For more information or get a FREE sample go to www.appraisaltoday.com/order Or call 510-865-8041, MTW, 7 AM to noon, Pacific time.

My comments: Rates are going up and down. We are all waiting for rates to drop lower in 2026.

Mortgage applications increased 0.4 percent from one week earlier

WASHINGTON, D.C. (February 25, 2026) — Mortgage applications increased 0.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending February 20, 2026.

The Market Composite Index, a measure of mortgage loan application volume, increased 0.4 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 2 percent compared with the previous week. The Refinance Index increased 4 percent from the previous week and was 150 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 5 percent from one week earlier. The unadjusted Purchase Index decreased 1 percent compared with the previous week and was 12 percent higher than the same week one year ago.

“Mortgage rates followed Treasury yields lower last week, with the 30-year fixed rate declining to 6.09 percent – its lowest level since September 2022. The decrease in rates was enough to drive a 5 percent increase in conventional refinance applications and a 26 percent increase in VA refinances,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “Purchase applications were down over the week but were 12 percent higher than a year ago, as the combination of lower rates and improving affordability conditions continue to support stronger demand than last year. The ARM share stayed above 8 percent, as ARM rates remained more than 80 basis points below conforming fixed rates. This is giving payment-sensitive borrowers or those seeking larger loans an incentive to choose this product offering.”

The refinance share of mortgage activity increased to 58.6 percent of total applications from 57.4 percent the previous week. The adjustable-rate mortgage (ARM) share of activity remained unchanged at 8.2 percent of total applications.

The FHA share of total applications decreased to 16.1 percent from 18.4 percent the week prior. The VA share of total applications increased to 18.7 percent from 16.5 percent the week prior. The USDA share of total applications remained unchanged at 0.4 percent from the week prior.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($832,750 or less) decreased to 6.09 percent from 6.17 percent, with points decreasing to 0.53 from 0.56 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The effective rate decreased from last week.

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $832,750) decreased to 6.20 percent from 6.21 percent, with points increasing to 0.42 from 0.27 (including the origination fee) for 80 percent LTV loans. The effective rate increased from last week.

The average contract interest rate for 30-year fixed-rate mortgages backed by the FHA decreased to 5.97 percent from 5.99 percent, with points remaining unchanged at 0.65 (including the origination fee) for 80 percent LTV loans. The effective rate decreased from last week.

The average contract interest rate for 15-year fixed-rate mortgages decreased to 5.48 percent from 5.50 percent, with points decreasing to 0.70 from 0.73 (including the origination fee) for 80 percent LTV loans. The effective rate decreased from last week.

The average contract interest rate for 5/1 ARMs decreased to 5.23 percent from 5.29 percent, with points decreasing to 0.41 from 0.62 (including the origination fee) for 80 percent LTV loans. The effective rate decreased from last week.

The survey covers U.S. closed-end residential mortgage applications originated through retail and consumer direct channels. The survey has been conducted weekly since 1990. Respondents include mortgage bankers, commercial banks, thrifts, and credit unions. Base period and value for all indexes is March 16, 1990=100.

———————————————————————–

Ann O’Rourke, MAI, SRA, MBA

Ann O’Rourke, MAI, SRA, MBA

Appraiser and Publisher Appraisal Today

1826 Clement Ave. Suite 203 Alameda, CA 94501

Phone: 510-865-8041

Email: ann@appraisaltoday.com

Online: www.appraisaltoday.com