Newz: UAD Quality Ratings,

Appraising with Inventory Shortages and Surpluses

December 5, 2025

What’s in This Newsletter (In Order, Scroll Down)

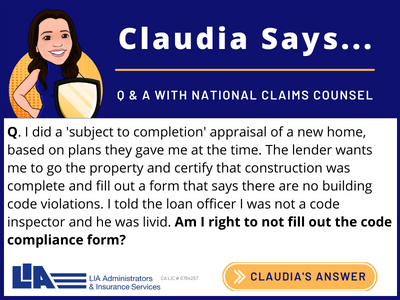

- LIA AD: When a Property Owner Wants to Do the Appraiser’s Job

- Understanding UAD Quality Ratings (Updated for UAD 3.6 and the New URAR)

- Gothic-Inspired ‘Fairytale Castle’ in Miami’s Exclusive Coconut Grove Michigan Hits the Market for $24 Million

- Navigating the Challenges of Inventory Shortages and Surpluses in Real Estate: Insights from a Chief Appraiser at a National AMC By Jim Jenkins, Chief Appraiser

- What Is a Scatter Chart Analysis in Appraisal?

- 53% of U.S. homes lost value in the past year, the most since 2012 – Zillow

- MBA: Mortgage applications decreased 1.4 percent from one week earlier

————————————-

Click here to subscribe to our FREE weekly appraiser email newsletter and get the latest appraisal news

————————————————

—————————————-

Understanding UAD Quality Ratings (Updated for UAD 3.6 and the New URAR)

Excerpts: Quality ratings are one of the most familiar parts of UAD, but the way appraisers report them has changed under UAD 3.6 and the new dynamic Uniform Residential Appraisal Report (URAR). While the Q1–Q6 scale remains in place, the way you apply, support, and reconcile quality is more structured and data-driven than in the legacy forms.

What “Quality” Means in UAD 3.6

In UAD 3.6, quality represents the materials, craftsmanship, and construction standards of a dwelling. The familiar Q1 through Q6 framework still applies, but the workflow is different:

Quality is no longer a single, form-level checkbox.

You now provide quality ratings in multiple places:

- Exterior Quality Rating (Dwelling Exterior section)

- Interior Quality Rating (Unit Interior section)

- Kitchen and Bathroom Detail tables

- Overall Quality (reconciled in Section 15)

- The “overall” rating is informed by the component-level data you report in these earlier sections.

Other topics include:

- What Does UAD Stand For?

- What Are the Quality of Construction Ratings?

- Breaking Down the UAD Quality Ratings (Q1–Q6)

- How Quality Is Applied in the New URAR

- Tips for Applying Quality Ratings Credibly

Final Thoughts

Quality ratings remain an important part of UAD, but the approach is more precise now. UAD 3.6 pushes appraisers to rely on observable details rather than broad descriptions or market norms. When you follow the definitions, support your ratings with the structured data, and reconcile logically, the quality rating becomes a clear and defensible part of your analysis.

To read more, Click Here

My comments: Comprehensive and well written. Worth reading.