Newz: Paired Sales Analysis, The Last Appraiser,

24 Hour Turn Times?

September 12, 2025

What’s in This Newsletter (In Order, Scroll Down)

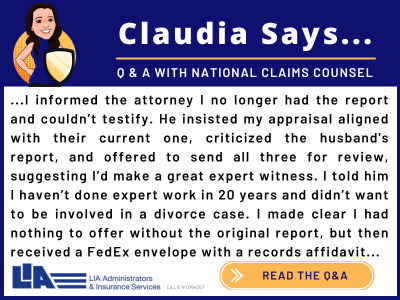

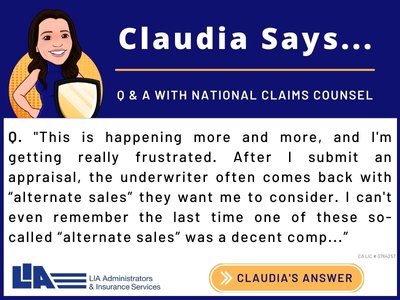

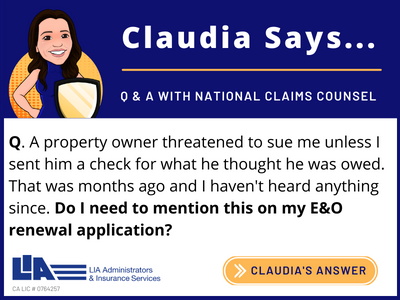

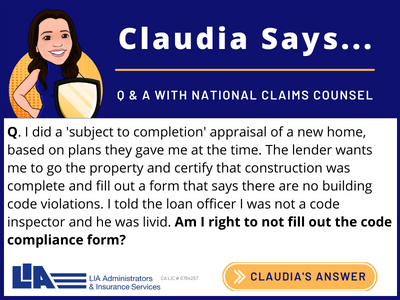

- LIA AD: Why do Claims get Settled?

- Paired Sales Analysis: Tips and Tools for Appraisers

- Home on rare stretch of California’s Lost Coast hits market for $11M in Ferndale, CA Some Assembly Required

- Combining Tools for Appraisals By Brent Bowen

- The 24-Hour Appraisal Diet: Slim on Time, Light on Credibility

- A Review of MEIN COMP: The Last Appraiser by Desiree Mehbod

- Mortgage applications decreased 1.2 percent from one week earlier

—————————————————————–

Tools To Support Appraisal Adjustments

Click here to subscribe to our FREE weekly appraiser email newsletter and get the latest appraisal news

———————————————————————

Paired Sales Analysis: Tips and Tools for Appraisers

By Kevin Hecht

Excerpts: As a professional real estate appraiser, you know that paired sales analysis is a reliable and popular method for determining the value of specific property features and providing market-based evidence to support appraisal adjustments.

Though not without challenges, paired sales analysis is a valuable technique to have in your appraisal toolkit. Mastering this method will help you develop more accurate, credible, and defensible appraisals.

Uses

Primarily used in the sales comparison approach, paired sales analysis is particularly useful for estimating the value of unique property attributes such as:

- Location advantages (corner lots, cul-de-sac positions, or waterfront access)

- Scenic views or privacy features

- Property upgrades (pools, finished basements, luxury kitchens)

Importance

For property appraisers, paired sales analysis is an essential tool because it helps ensure that appraisal adjustments are supported by quantitative data. Rather than relying on cost estimates or subjective opinions, you can use actual sales data to support your value conclusions. This evidence strengthens your appraisal’s defensibility and helps you comply with USPAP.

Additional Topics

- Step-by-Step Methodology of a Paired Sales Analysis

- Paired Sales Analysis Tips and Best Practices

My comments: Paired sales has been used for decades by appraisers. Now, statistical analysis including graphs is available plus software that can determine adjustments. In the 8/25 issue of this newsletter, an appraiser survey of appraisal adjustments said that paired sales was the number one adjustment method used by appraisers.

I use paired sales for unusual adjustments, such as discussed above. For example, for many years I lived in waterfront homes, which is not unusual in my city. One of my homes was in a small development of similar homes built in the 1940s. Matched paired sales was very easy. Another non tract home built in the 1940s did not have similar homes nearby and paired sales did not work very well there.

To read more, Click Here