Newz: Limited Comps, Freddie Mac: Property Data Collection, Avoiding ourt

January 23, 2026

What’s in This Newsletter (In Order, Scroll Down)

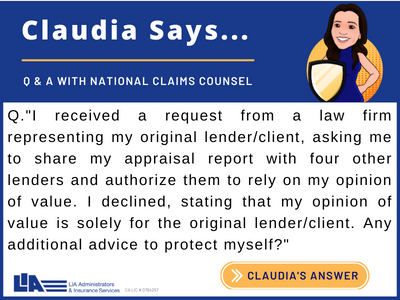

- LIA AD: Avoiding Court

- Arriving at a Credible Appraisal When Comparable Sales Are Limited By Kevin Hecht

- MAPPED: The Most Expensive Home Sales of 2025—From Palantir CEO’s Record-Breaking Ranch to Florida’s Priciest Mansion

- MY AD: The AMC Conundrum in the Appraisal Business by Dave Towne

- From Data to Value: How Mass Appraisal Delivers Fair Market Assessments

- Freddie Mac. Insight Articles: Property Data Collection: An Overview

- Housing Market Predictions for 2026

- MBA: Mortgage applications increased 14.1 percent from one week earlier

———————————————————————–

Click here to subscribe to our FREE weekly appraiser email newsletter and get the latest appraisal news

Arriving at a Credible Appraisal When Comparable Sales Are Limited

By Kevin Hecht

Excerpts: Limited sales activity is common in rural markets, custom-home neighborhoods, and low-turnover areas. When comps are few, the appraiser’s task is not to find perfect matches, but to show that the selected sales are the best available indicators of value and that all departures from ideal data are well supported.

In this article, we’ll answer questions like: How far back do appraisers look for comps? How far out geographically? What other tips and tricks do appraisers use to arrive at a credible appraisal, even when comps are limited? Additionally, we’ll share some insights from appraisers who answered our survey question, “What do you do when appraisal comps are few?”

When recent, proximate, and similar sales are unavailable, appraisers typically rely on some combination of the “Three D’s” to broaden their search for comparable property sales:

Dated – Search for older sales within the subject neighborhood.Distant – Search for similar sales farther away in competing neighborhoods.

Dissimilar – Search for dissimilar sales within the subject neighborhood by widening the parameters for improvements (GLA, age, features, etc.).

How Far Back Do Appraisers Look for Comps?

Time adjustments draw scrutiny. Most agency assignments expect appraisers to use the most recent closed sales available, typically within the prior 12 months when possible.1 When older sales are used, market conditions adjustments often become central to the analysis.

Time adjustments should be supported with clear data, applied consistently, and reconciled logically. Underwriters pay close attention to whether these adjustments reflect documented market behavior rather than assumptions, particularly in shifting markets.

We surveyed our appraisal community to find out, “What do you do when appraisal comps are few?” The following comments show how individual appraisers often put their own spin on the “Three D’s” when expanding the search for comparable sales:

“Time and distance. My preference is to go back farther in time within the same neighborhood and/or market area and make market condition adjustments. If that still doesn’t provide enough comps, I expand the market area, looking for more recent sales with similar characteristics to the subject property.”

“First consider a broader time frame. Market conditions adjustments are very supportable.”

“Expand search to other competitive neighborhoods. Next, go back in time.”

To read more, Click Here

My comments: I usually go back in time sometimes several years or longer if needed. Of course, I don’t do GSE appraisals with their restrictions…