Newz: HUD and OMB PAVE Rollback, Appraiser Appraisal Capacity, Fraud Alert

July 18, 2025

What’s in This Newsletter (In Order, Scroll Down)

- LIA ad: Can’t Certify the Work

- Exposure Time vs. Marketing Time: Why the Clock Matters in Appraisals By Jamie Owen

- Historic Beachfront Water Tower That Has Been Transformed Into a Sky-High Home in California for $5.5 Million

- Freddie Mac. Appraiser Capacity

- HUD and OMB Begin Rollback of PAVE Task Force

- Fraud Alert: Some Non-QM Lenders Excluding Loans Involving Certain Appraisers, Borrowers

- Mortgage applications decreased 10.0 percent from one week earlier

——————————————————

Click here to subscribe to our FREE weekly appraiser email newsletter and get the latest appraisal news

—————————————————————————

—————————————————————————–

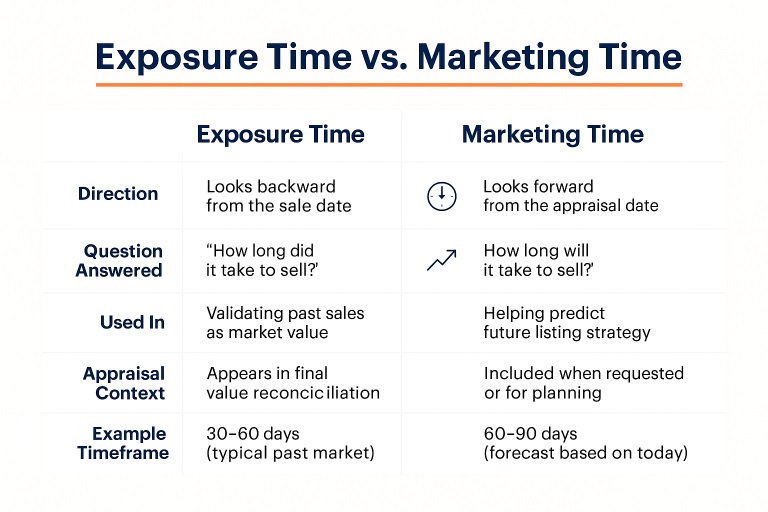

Exposure Time vs. Marketing Time: Why the Clock Matters in Appraisals

By Jamie Owen

Excerpts: Exposure Time: The Clock That Ticks Backward

Imagine standing in the kitchen of a colonial in Gordon Square that just sold last week. The buyers are thrilled, the sellers are relieved, and the agent is probably already on to the following listing. But in that moment, the appraiser has to ask: how long would this house have needed to be on the market to attract a willing buyer and sell at that exact price?

That’s exposure time—the hypothetical time the property was exposed to the open market before the sale, assuming it sold for fair market value.

Appraisers include this estimate to show that the sale wasn’t rushed, distressed, or out of step with the broader market. It’s a way of saying: “This was a typical deal in a typical market, and the sale price reflects that.”

Marketing Time: The Clock That Ticks Forward

Let’s shift the scene. You’re standing in the living room of a Cleveland Heights Tudor, preparing an appraisal for a homeowner who’s thinking about listing soon. They want to know not just what it’s worth today, but how long it might take to se

My comments: Worth reading. Excellent understandable article and graphic above. Good Case Study (A Hypothetical Example). Written for home owners, real estate agents, etc. but a good review for appraisers. This topic can be confusing for appraisers.

—————————————————————————————-

Historic Beachfront Water Tower That Has Been Transformed Into a Sky-High Home in California for $5.5 Million

Excerpts: The historic Seal Beach Water Tower dates to 1892, when it was built to hold water for passing steam engines, a role that it held for nearly 100 years.

In 1985, it was converted into a 2,828-square-foot, single-family residence that quickly became one of the most talked-about dwellings in Seal Beach. The interest appears to be alive and well 40 years later, with the home quickly shooting to the top of the week’s most popular homes list.

History buffs will love the four-bedroom home’s period details, including a vintage tool display “unearthed during the 1940s tribute” and a bedroom “themed after the only known pirate to haunt these shores.”

Other eye-catching updates include a foyer water feature; an elevator and circular staircase for easy access; a compass rose design found in the hardwood floors; a third-floor modern kitchen; a model train “weaving through the rafters”; a fifth-level, open-air rotunda; and a stained-glass cupola.

To read the listing and see 74 photos, Click Here

My comments: Very interesting! Check out the photos. I love the elevator: a long way to the top…

Posted in: appraisal business, appraisal how to, bad appraisers, bias