What is an Appraiser? Humor, Upzoning,

New UAD Quality Ratings

August 15, 2025

What’s in This Newsletter (In Order, Scroll Down

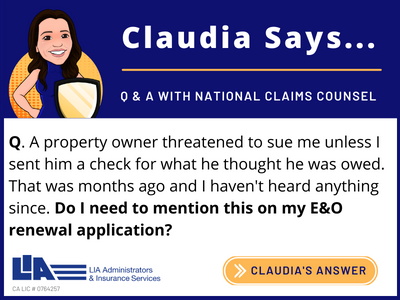

- LIA AD: A Family feued and Intended Use

- Upzoning: What It Is and What Appraisers Need to Know

- Off-Grid ‘Stilt Home’ That Hovers Above a St. Augustine Beach Hits the Market for $1.35 Million

- What Is An Appraiser? Humor

- The New UAD Quality Equation: Interior + Exterior = Overall Rating

- The Harbor Model: Where Appraisers Take the Helm

- Mortgage applications increased 3.1 percent from one week earlier,

——————————————————————————-

Click here to subscribe to our FREE weekly appraiser email newsletter and get the latest appraisal news

—————————————————————————

Upzoning: What It Is and What Appraisers Need to Know

Excerpts: Upzoning is a powerful but often misunderstood tool in urban planning and real estate. In this post, we’ll break down what upzoning is, why it’s becoming more prevalent, and what appraisers need to know about its potential impact on property values.

What Is Upzoning?

Upzoning is the process of modifying zoning laws to allow for higher-density development in areas that previously had stricter land-use regulations. This might include permitting multi-family housing where only single-family homes were allowed, increasing building height limits, or reducing minimum lot sizes. The goal is often to promote more efficient land use and address housing shortages.

What to Be Aware of as an Appraiser

It’s important for real estate appraisers to stay informed about changes in local zoning laws, as these can significantly affect property valuations. Upzoning, in particular, can alter what is legally permissible on a parcel of land, shifting development potential and land use expectations.

When upzoning occurs, the highest and best use of a property may change—from a single-family home to a multi-family development, for example—requiring appraisers to reassess the property’s value accordingly.

How to Address Upzoning in Your Appraisal Report

If you find that a property has been upzoned, how do you tackle that in your actual appraisal report? “I think the place to start is building permitting,” says Dobbs. “A lot of cities have pretty decent permitting websites. You can go in there and look at what types of permits are being pulled in the area.”

More topics:

- How to Address Upzoning in Your Appraisal Report

- Opportunities for Real Estate Appraisers

- How to Prepare for Future Upzoning

To read more, Click Here

My comments: Excellent, understandable article about this important topic. There are rental housing shortages in many areas in U.S. Today there is pressure to allow upzoning to make more rental housing available.

Residential appraisers did not receive much education on this topic. You don’t want to get into trouble with the state board by using the incorrect highest and best use on a property or not recognizing and reporting on upzoning.

I do commercial appraisals. HBU issues occur regularly in my city, so I keep up on zoning changes.

Don’t forget local regulations. In my city, regulations (not in zoning regs) restricts the number of rental units on a property (downzoning) after many Victorians were demolished and ugly modern apartment buildings constructed in the early 1960s. Appraisers only looking at zoning for HBU would make a very big mistake.

—————————————————————————————-

Off-Grid ‘Stilt Home’ That Hovers Above a St. Augustine Beach Hits the Market for $1.35 Million

Excerpts 4 bedroom 3 baths,3,374 square feet, 0.41acre lot, built in 1980

Beachfront homes that offer instant access to white sand and a crystal-clear ocean are a rare find—but even rarer is a dwelling that sits directly atop that beachfront, mere feet away from the water.

Yet one such property has just washed ashore in St. Augustine, FL, listed for $1.35 million, 19 years after it last changed hands for less than a sixth of that price.

This unique dwelling is situated on large wooden stilts that have been hammered into the sand, providing the perfect perch overlooking the water, ensuring 24/7 beach access—a rare amenity that comes with its fair share of complications.

Unsurprisingly, given its location, the home is classified as being at “extreme” risk of flooding, according to the Realtor.com® Flood Factor rating, which notes that the dwelling has a “100% risk of flooding” over the next 30 years.

Additionally, the “stilt house” has an extreme wind factor rating, as well as an extreme risk of hotter-than-average temperatures.

To read more Click Here

To read the listing with 59 photos and a video tour, Click Here

————————————————————————-

What Is An Appraiser? Humor

An appraiser is one who compiles and analyzes voluminous data of problematical accuracy from sources of dubious veracity and derives therefrom a numerical quantification of unquestionable necessity,

analogous to a nebulous and euphemistic concept representational of value commensurate with ambient configurations of the open market

and promulgates thereby a precise written declamation which delineates his observation, deliberations and conclusions all done while he feigns absolute ignorance of the avaricious machinations of Buyers, Sellers, Brokers and Lenders, compensated only by that penurious stipend known as the professional fee.

This joke is from Bill Sparks. Bill doesn’t know where this joke originated, but Thanks for sending it to us!

My comments: We all need a little appraiser humor!

Read more!! →