Newz: ANSI and UAD 3.6, Trainee Inside the Fast and Cheap Model

February 13, 2026

What’s in This Newsletter (In Order, Scroll Down)

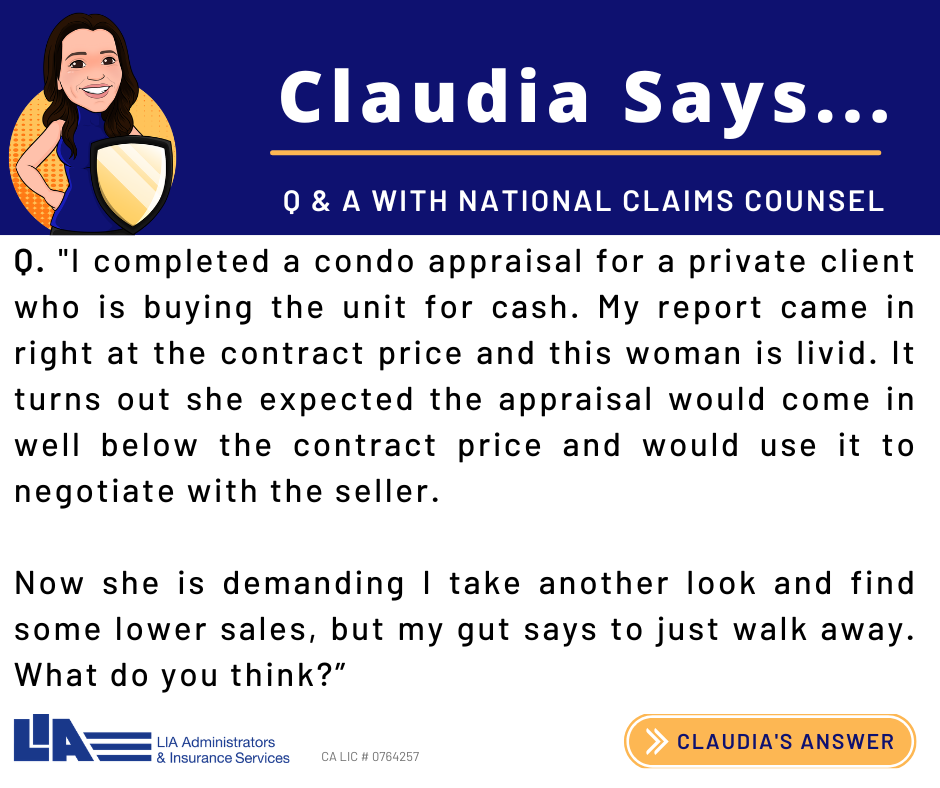

- LIA AD: Buyer Wants Lower Price to Negotiate

- ANSI Z765 and the New UAD 3.6: What Appraisers Need to Know

- New York Lumber Baron’s Private Island Retreat Hits the Market for $2.7 Million—With a Historic 8-Bedroom Mansion

- We Will Always Need Appraisers: Josh Walitt on Valuation, Technology, and Adaptability By Isaac Peck, Publisher WorkingRE

- MY AD: What is new in the New URAR. List of data requests for each page of UAD 3.6 SFR report.

- The Trainee Inside the Fast and Cheap Model

- The Ethics of Credibility in Real Estate Appraisal By Timothy Andersen, MAI

- MBA: Mortgage applications decreased 0.3 percent from one week earlier

———————————————–

Click here to subscribe to our FREE weekly appraiser email newsletter and get the latest appraisal news

—————————————-

——————————————————-

ANSI Z765 and the New UAD 3.6: What Appraisers Need to Know

Excerpts:

Why ANSI Z765 Matters More Under UAD 3.6

Fannie Mae and Freddie Mac have both adopted ANSI Z765 as the standard for measuring one-unit detached and attached dwellings. For years, ANSI shaped how appraisers calculated gross living area, but measurement practices still varied from one professional to another. Under the new UAD 3.6 framework, those differences matter more because:

The URAR now breaks out finished area by level, making ANSI designations part of the form structure.

Lenders run automated checks that compare the sketch, GLA figures, and room-level data for consistency.

Any mismatch can trigger a revision request, a CU warning, or a QC hold.

In short, ANSI is no longer just a best practice. It’s now deeply connected to how the form captures data and how lenders review appraisals.

Core ANSI Rules that Every Appraiser Must Apply

ANSI Z765 is the national standard for measuring single-family homes. Appraisers must follow the standard in full when required by the assignment. Key elements include:

Above-Grade vs. Below-Grade

A basement is any area partially or fully below grade, regardless of finish. Even if it includes high-quality living space, it must be reported as below-grade finished area, not GLA.

Ceiling Height Requirements….

To read more, Click Here

My comments: Good review of ANSI standards and how they change with UAD 3.6

Cosmetic vs. MPR Repairs: Guidance for FHA Appraisers

Cosmetic vs. MPR Repairs: Guidance for FHA Appraisers