Newz: Appraisal Regulator Chaos , Cat and Raccoon Damages, Wildfire Risks

September 5, 2025

What’s in This Newsletter (In Order, Scroll Down)

NOTE: Scroll down to see Appraisal Regulator Chaos

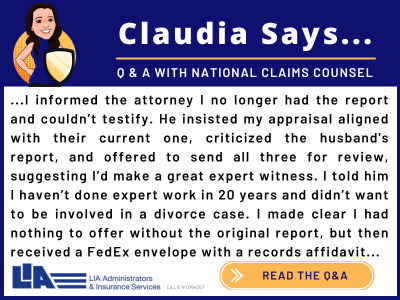

- LIA AD: Legal Request for Old Appraisal

- The Kitty Litter Duplex: An Appraisal I Wish to Not Remember

- $300K Maryland Home Is Overrun by Feral Cats and Raccoons

- The Full Measure August 2025: Navigating Rates, Inventory, and Affordability

- Appraisal Regulatory Chaos

- The Town With No Bank: How Rural America Lost Its Mortgage Lifeline By Dallas T. Kiedrowski, MNAA

- New Cotality Wildfire Risk Report finds more than 2.6 million homes are exposed to moderate or greater wildfire risk

- Mortgage applications decreased 1.2 percent from one week earlier

—————————————————————

Click here to subscribe to our FREE weekly appraiser email newsletter and get the latest appraisal news

————————————————-

———————————————————–

The Kitty Litter Duplex: An Appraisal I Wish to Not Remember

Excerpts: How one property’s furballs left an unforgettable impression on an apartment and an appraiser

Introduction

In the world of real estate, surprises abound. Industry professionals, especially appraisers, all expect the unexpected, but even the most seasoned professionals can stumble across situations that test the limits of their experience, composure, and their judgement. There are stories of haunted houses, collapsing ceilings, and outlandish tenant actions and decorative choices (Live, Laugh, Love), but the tale of the cat-soiled duplex stands out for its sheer yuck-factor. This is the story of what should be a routine property appraisal, which became cemented in my experience stories, due to its unfathomability and coated in an unmistakable, noxious layer of feline mischief.

The Setting: An Unimposing Duplex with a Dirty Little Secret…

The Appraisal Appointment: An Unforgettable First Impression

…I could only see the flooring in the opening and a few other spots around the living room from about a foot outside the threshold, the rest of the floor was completely caked with cat poop. The walls, ceiling, and windows were all enveloped by heavy spider webs in a variety of states, while some were fresh looking, others clearly blackened from a long life filled with dust, dirt, fur, and of course fecal matter. Also, you could see multiple patches of orange mold scattered throughout the walls and ceiling. I quickly replied I would not be going in there, because it was a danger to my health and safety, which somehow surprised her….

Financial and Health Implications: When Cleanliness Becomes a Value Killer

Hygiene, general maintenance, and property values parallel each other. This may be why we have condition codes for our appraisals. Just saying…. I made sure to thoroughly explain the situation and how the value was determined in the report. I did not want this rolling back downhill and getting me. Luckily, a very gracious Fresno Construction, was able to give me a quote very quickly, which came just over $100,000 for an estimate to redo the unit in its entirety.

Conclusion

The Kitty Litter Unit stands as a testament to both the resilience of a property and the unpredictability investors face. Especially in this case, since it was for an estate of a deceased former owner.

To read more, Click Here

My comments: I appraised a house for a relocation company – one story with 3 bedrooms. There were cats on every surface above the floor, such as dressers, – all staring at me of course. In the rear of the home was a very large cat enclosure. They were rescue cats, temporarily at the home. I did not ask the owner where the cats would go when she relocated – back to the shelter or with go with her. I will never forget about all those cat eyes staring at me!

I had another relocation appraisal where the male cat had sprayed urine along several walls in the living room. I told the relocation company to replace the drywall.

Of course, I could fill up a book with dog stories. Such as two Dobermans that broke down the door of a trailer to get to me. I somehow made it to my car and I will never forget it. Or the small dogs who bit my ankles as I was trying to get through the front door (home was owned by an appraiser I knew). For both appraisals, I told my lender client to get another appraiser.