Newz: California College offers Appraiser Training, Appraiser Adjustments

October 24, 2025

What’s in This Newsletter (In Order, Scroll Down)

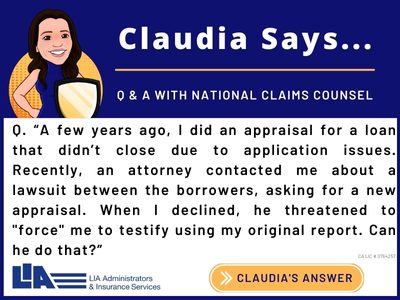

- LIA AD: Can an Attorney Really Force Me to Testify?

- How to Defend Adjustments in Appraisal Reports By Jo Traut

- Monumental Hollywood Hills Megamansion That Took 10 Years To Complete Is Listed for $125 Million

- West Los Angeles Community College Launches More Accessible Home Appraiser Training Program

- Flooded With Change: Appraisers Tackle a Dynamic URAR and UAD 3.6 by Isaac Peck

- Mortgage Rates Won’t Fall Below 6% Anytime Soon, Top Economist Says in Grim Forecast

- Mortgage applications decreased 0.3 percent from one week earlier

——————————————————-

Click here to subscribe to our FREE weekly appraiser email newsletter and get the latest appraisal news

—————————————————————

How to Defend Adjustments in Appraisal Reports

By Jo Traut

Excerpts: Appraisal reports are similar to scientific papers. A scientist can’t write “Based on my experiments, the hypothesis is correct” and expect peer review to accept it. Scientists need to share their methodology, summarize their analysis, and support their conclusions.

The same applies to appraisal adjustments. Saying you used market data is like saying you conducted an experiment—it’s just the starting point. Your report needs to summarize how you analyzed the data and how it supports that specific adjustment.

Without this documentation, you haven’t provided credible analysis—you’ve stated an unsupported opinion, regardless of your experience.

Topics:

Start with the Right Sequence

Equalize Market Conditions Before You Compare

Move Beyond “Paired Sales or Bust”

Mini Example: Defending a GLA Adjustment

Show Your Work the Way Reviewers Want to See It

To read more, Click Here

My comments: Worth reading. Excellent article covering the important topics.

———————————————————-

Monumental Hollywood Hills Megamansion That Took 10 Years To Complete Is Listed for $125 Million

Excerpts: 7 bedrooms, 12 baths, 22,000 sq.ft. 0.97 acre lot, built in 2025

The 22,000-square-foot spec mansion, which was designed by Scott Mitchell, took 10 years to build and boasts a “layered and terraced” estate designed for grand-scale entertaining. A vertical water feature can be found along the entrance walkway.

Lavish details found inside the three-story residence include a living room with a fireplace and retractable glass wall overlooking a spacious patio with breathtaking views, a grand dining room designed for entertaining, a home bar, and a primary suite with a private terrace.

The 22,000-square-foot spec mansion, which was designed by Scott Mitchell, took 10 years to build and boasts a “layered and terraced” estate designed for grand-scale entertaining. A vertical water feature can be found along the entrance walkway.

Lavish details found inside the three-story residence include a living room with a fireplace and retractable glass wall overlooking a spacious patio with breathtaking views, a grand dining room designed for entertaining, a home bar, and a primary suite with a private terrace.

To read the listing with 55 photos, Click Here

—————————————————————–

West Los Angeles Community College Launches More Accessible Home Appraiser Training Program

West Los Angeles College has been awarded a $100,000 grant from Wells Fargo to launch a groundbreaking real estate appraiser education program this Fall.

This is a first-of-its-kind, Bureau of Real Estate Appraisers (BREA)-approved program that provides aspiring appraisers with an innovative pathway to licensure without the traditional supervisory requirement. Students will engage directly with licensed appraisers and gain exposure to real-world property appraisal assignments.

The new program offers a structured, classroom-based alternative to the conventional one-on-one apprenticeship model, creating greater access for students from all backgrounds. Real estate appraisal has historically faced challenges in attracting and retaining talent, in part due to reliance on hard-to-access mentorship models.

West’s program is among the first in California to offer an alternative, competency-based pathway to licensure, expanding opportunities for those previously shut out by traditional entry points. Additionally, some students may qualify for course credit for prior learning.

To read the press release, Click Here

For more details on the program directly from the college, Click Here

————————————————————–

Are you getting too many ad-only emails?

4 ways to get only the FREE email newsletters and NOT the ad-only emails.

1. Twitter: https://twitter.com/appraisaltoday Posted by noon Friday

2. Read on blog www.appraisaltoday.com/blog Posted by noon Friday. You can subscribe to the blog in the upper right of each blog page. NOTE: the popular ads with liability tips are below the first topic on my blog posts.

3. Email Archives: https://appraisaltoday.com/archives

(posted by noon Friday) The link is above and to the left of the big yellow email signup form. Newsletters start with “Newz.” Contains all recent emails sent.

4. Link to the 10 most recent newsletters (no ads) at www.appraisaltoday.com. Scroll down past the big yellow signup block. The newsletters have abbreviated titles, taken from their blog posts.

To read more about the 4 ways, plus information on why I take ads, etc.

————————————————————————-

Previous articles in this newsletter on UAD 3.6

April 2025 – first article

New URAR What It Means for Appraisers

Fannie Q and As and other information available in April.

————————————-

May 2025

Review of Appraiser’s Guide to the New URAR Class

How to use Document F-1 to find what GSEs want in the PDF Report plus other introductory information and a review of the class.

—————————————

June 2025

What is new in the New URAR

Introduction to UAD 3.6 and more info on topics in May 2025 and Scenario SR 1 – Single Family, used in many demos and discussions. I go through every page of the 20 page document and include what is new with references document F-1

Additional PDFs (on Paid subscriber web page):

Sample Scenario SF1 (Single Family) PDF Report – discussed in this article

Appendix F-1 URAR Reference Guide v1.2 14 MB

Fannie Sample Scenario PDFs Combined 15MB All scenarios

———————————–

July 2025

From UAD 2.6 to UAD 3.6.

What appraisal software vendors are doing

First article on this topic. I had live demos on Bradford, alamode, and SFREP. I asked them specific questions about fields. None of the vendors were “ready to go” on their software. 5 screen shots are included at the end of the article.

November 2025 (coming Nov. 1)

UAD 3.6 Update – Software Vendors, Both Old and New and More Info on why it is taking so long to get software completed. None have completed it yet (verification from GSEs)

To read the articles, plus 3+ years of previous issues, subscribe to the paid Appraisal Today at www.appraisaltoday.com/order .

Not sure if you want to subscribe?

Sign up for monthly auto renewal for $8.25!

Cancel at any time for any reason! You will receive a prorated refund.

$8.25 per month, $24.75 per quarter, and $89 per year (Best Buy)

or $99 per year or $169 for two years

Subscribers get FREE: past 18+ months of past newsletters

What’s the difference between the Appraisal Today free Weekly email newsletter and the paid Monthly newsletter? Click here for more info.

————————————————————–

If you are a paid subscriber and did not receive the

October 2025 issue emailed on

Wednesday, October 1, 2025 please email info@appraisaltoday.com, and we will send it to you. You can also hit the reply button. Be sure to include a comment requesting it.

————————————————-

Flooded With Change: Appraisers Tackle a Dynamic URAR and UAD 3.6

by Isaac Peck, Publisher

Excerpts: Lenders and appraisal management companies have until November 2, 2026, to fully implement UAD 3.6. While this phased approach creates breathing room for system updates and staff training, it also introduces a period of mixed requirements that could be confusing for both appraisers and lenders.

Software vendors and large lenders are racing to update their platforms, with some taking a “first mover” stance on UAD 3.6. Smaller lenders tend to sit back and watch how early adopters navigate the inevitable hiccups. As a result, appraisers may face varying expectations depending on which lender or AMC they’re working with during the transition.

The scope of these changes is so broad that both GSEs partnered with leading education providers on a seven-hour continuing education course. They recognize that appraisers need thorough, standardized training to master the new data fields, digital workflows, and report structures.

This article will highlight the most consequential developments in UAD 3.6 and the redesigned URAR, share insights from industry leaders, and outline the key areas appraisers should monitor over the next 18 months.

Topics include:

A Challenging Transition

Lender Perspective

Software Views

Liability Considerations

Advice for Appraisers

To wrap things up, Working RE talked to Hal Humphreys, partner at Appraiser eLearning and a seasoned instructor, to get his take on how appraisers are responding to UAD 3.6 and the redesigned URAR. Humphreys has taught the GSEs’ new course nationwide and says he’s seen plenty of fear—but also a shift once appraisers dug in.

“When I start every class, I ask how many plan to retire once the new URAR is mandatory. Anywhere from 15 to 50 percent raise their hands,” he says. “By the end of the class, usually nobody does. Or maybe a couple but they were going to retire anyway. Once folks start digging into it, I think it’s very doable.”

Humphreys’ advice? Take the class and start using mobile tech. “Don’t try to take notes. Just listen. And if you’re not using a mobile process now, start today. It’s not mandatory, but it’s highly recommended. Mobile inspection apps are the perfect checklist. Without them, you’ll forget things and spend way more time later.”

While the new data fields may make inspections longer at first, Humphreys believes that comfort with mobile tools will help appraisers maintain efficiency. “Once you’re back at the office, you’re not transcribing notes or doing a sketch; it’s already done. You can focus on market analysis and adjustments.”

To read more, Click Here

My comments: Read This Article!!There were recently two national appraisal events. Both focused on UAD 3.6. This article is the most comprehensive article I have read.

——————————————————–

Mortgage Rates Won’t Fall Below 6% Anytime Soon, Top MBA Economist Says in Grim Forecast

October 20, 2025

Excerpts: Mortgage rates could remain stuck above 6% for the next several years, according to newly released projections from the economists at the Mortgage Bankers Association.

MBA Chief Economist Mike Fratantoni presented the forecast at the group’s annual conference in Las Vegas on Sunday, projecting that 30-year fixed mortgage rates will remain roughly in the range of 6% to 6.5% through the end of 2028.

“As we move over the next couple of years, we think it’s more likely that long [term] rates are going to go up rather than down, given the fiscal pressures on the economy,” Fratantoni told the conference, referring to the impact of rising federal deficits on bond markets.

To read more, Click Here

———————————————————–

HOW TO USE THE NUMBERS BELOW. Appraisals are ordered after the loan application. These numbers tell you the future for the next few weeks. For more information on how they are compiled, Click Here.

Note: I publish a graph of this data every month in my paid monthly newsletter, Appraisal Today. For more information or get a FREE sample go to www.appraisaltoday.com/order Or call 510-865-8041, MTW, 7 AM to noon, Pacific time.

My comments: Rates are going up and down. We are all waiting for rates to drop in 2025.

Mortgage applications decreased 0.3 percent from one week earlier

The Market Composite Index, a measure of mortgage loan application volume, decreased 0.3 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 0.2 percent compared with the previous week. The Refinance Index increased 4 percent from the previous week and was 81 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 5 percent from one week earlier. The unadjusted Purchase Index decreased 5 percent compared with the previous week and was 20 percent higher than the same week one year ago.

“The lowest mortgage rates in a month spurred an increase in refinance activity, including another pickup in ARM applications. The 30-year fixed rate decreased to 6.37 percent and all other loan types also decreased,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “The refinance index increased 4 percent, driven by a 6 percent increase in conventional refinances and a 12 percent increase in FHA refinance applications, as borrowers remain attentive to these opportunities to lower their monthly mortgage payment. VA refinances bucked the trend and were down 12 percent.”

Added Kan, “ARM applications increased 16 percent over the week, which pushed the ARM share to 11 percent, with the ARM rate more than 80 basis points lower than the 30-year fixed rate. Purchase applications were down over the week but remained 20 percent higher than a year ago.”

The refinance share of mortgage activity increased to 55.9 percent of total applications from 53.6 percent the previous week. The adjustable-rate mortgage (ARM) share of activity increased to 10.8 percent of total applications.

The FHA share of total applications increased to 21.8 percent from 20.5 percent the week prior. The VA share of total applications decreased to 13.5 percent from 14.9 percent the week prior. The USDA share of total applications decreased to 0.3 percent from 0.4 percent the week prior.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($806,500 or less) decreased to 6.37 percent from 6.42 percent, with points decreasing to 0.59 from 0.61 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The effective rate decreased from last week.

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $806,500) decreased to 6.39 percent from 6.47 percent, with points decreasing to 0.37 from 0.53 (including the origination fee) for 80 percent LTV loans. The effective rate decreased from last week.

The average contract interest rate for 30-year fixed-rate mortgages backed by the FHA decreased to 6.12 percent from 6.19 percent, with points decreasing to 0.72 from 0.76 (including the origination fee) for 80 percent LTV loans. The effective rate decreased from last week.

The average contract interest rate for 15-year fixed-rate mortgages decreased to 5.74 percent from 5.77 percent, with points decreasing to 0.67 from 0.70 (including the origination fee) for 80 percent LTV loans. The effective rate decreased from last week.

The average contract interest rate for 5/1 ARMs decreased to 5.55 percent from 5.63 percent, with points increasing to 0.62 from 0.59 (including the origination fee) for 80 percent LTV loans. The effective rate decreased from last week.

If you would like to purchase a subscription of MBA’s Weekly Applications Survey, please visit www.mba.org/WeeklyApps, contact mbaresearch@mba.org or click here.

The survey covers U.S. closed-end residential mortgage applications originated through retail and consumer direct channels. The survey has been conducted weekly since 1990. Respondents include mortgage bankers, commercial banks, thrifts, and credit unions. Base period and value for all indexes is March 16, 1990=100.

————————————————————

Ann O’Rourke, MAI, SRA, MBA

Ann O’Rourke, MAI, SRA, MBA

Appraiser and Publisher Appraisal Today

1826 Clement Ave. Suite 203 Alameda, CA 94501

Phone: 510-865-8041

Email: ann@appraisaltoday.com

Online: www.appraisaltoday.com

Unique Bathrooms

Unique Bathrooms